Intermediate : Calculation of labour, material and ov erhead var iances plus appropriate accounting en tries JC

Question:

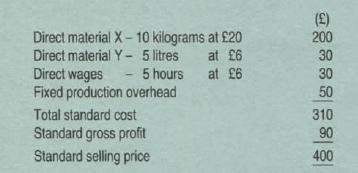

Intermediate : Calculation of labour, material and ov erhead var iances plus appropriate accounting en tries JC Limited produces and sells one product only, Product J, the standard cost for which is as follows for one unit.

The fixed production overhead is based on an expected annual ou1put of 1 0 800 un~ts produced at an even flow throughout the year; assume each calendar month ts equal. Fixed productton overhead is absorbed on direct labour hours.

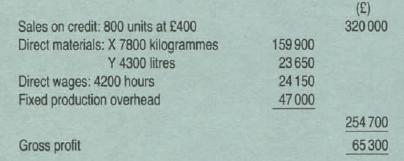

During April , the first month of the 1989190 financial year. the following were the actual results for an actual production of 800 units.

The material price variance ts extraced at the time of receipt and the raw materials stores control is maintained at standard prices.

The purchases , bought on credit . dunng the month of April were :

X 9000 kilograms at £20.50 per kg from K Limited Y 5000 htres at £5.50 per litre from C p.l.c.

Assume no opening stocks Wages owtng for March brought forward were £6000.

Wages paid during April (net) £20 150.

Deductions from wages owing to the Inland Revenue for PAYE and Nl were £5000 and the wages accrued for April were £5000.

The fixed production overhead of £47000 was made up of expense creditors of £33 000. none of which was paid in April, and depreciation of £14000 .

The company operates an integrated accounting system .

You are required to

(a) (i) calculate price and usage variances for each material , (ii) calculate labour rate and effictency vanances.

(iii) calculate fixed production overhead expenditure, efficiency and volume variances ; (9 marks)

(b) show all the accounting entries tnT accounts for the month of April- the work·in·progress account should be maintained at standard cost and each balance on the separate variance accounts is to be transferred to a Profit and Loss Account which you are also required to show ;

(18 marks)

(c) explain the reason for the difference between the actual gross profit gtven in the question and the profit shown in your profit and loss account.

Step by Step Answer: