Intermediate: Calculation of overhead absorption rates and an explanation of the differences in profits A company manufactures

Question:

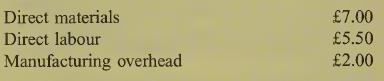

Intermediate: Calculation of overhead absorption rates and an explanation of the differences in profits A company manufactures a single product with the following variable costs per unit

The selling price of the product is £36.00 per unit. Fixed manufacturing costs are expected to be £1 340000 for a period. Fixed non-manufacturing costs are expected to be £875 000. Fixed manufac¬ turing costs can be analysed as follows:

60% of service department costs are labour related and the remaining 40% machine related.

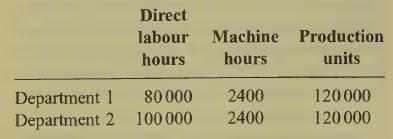

Normal production department activity is:

Fixed manufacturing overheads are absorbed at a predetermined rate per unit of production for each production department, based upon normal activity.

Required:

(a) Prepare a profit statement for a period using the full absorption costing system described above and showing each element of cost separately. Costs for the period were as per expectation, except for additional expenditure of £20000 on fixed manufacturing overhead in Production Department 1. Production and sales were 116000 and 114000 units respec¬ tively for the period. (14 marks)

(b) Prepare a profit statement for the period using marginal costing principles instead. (5 marks)

(c) Contrast the general effect on profit of using absorption and marginal costing systems respectively. (Use the figures calculated in

(a) and

(b) above to illustrate your answer.)

Step by Step Answer: