The directors of Anhang pic are considering how best to invest in four projects, details of which

Question:

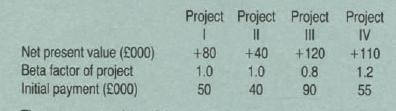

The directors of Anhang pic are considering how best to invest in four projects, details of which are given below.

The net present values of the projects have been calculated using specific. risk-adjusted discount rates. The director's choice is complicated because Anhang pic has only £90000 currently available for investment in new projects. Each project must start on the same date and cannot be deferred. Acceptance of any one project would not affect acceptance of any other and all projects are divisible. The directors at a recent board meeting were unable to agree upon how best to invest the £90 000. A summary of the views expressed at the meeting follows:

(i) Wendling argued that as the presumed objective of the company was to maximize shareholder wealth, project Ill should be undertaken as this project produced the highest net present value.

(ii) Ramm argued that as funds were 1n short supply investment should be concentrated in those projects with the lowest in~ial outlay, that is in projects I and II.

(iii) Ritter suggested that project Ill should be accepted on the grounds of risk reduction. Project Ill has the lowest beta, and by its acceptance the risk of the company (the company's present beta is 1.0) would be reduced. Ritter also cautioned against acceptance of project IV as it was the most risky project; he pointed out that its high net present value was, in part, a reward for its higher level of associated risk.

(iv) Punto argued against accepting project Ill, stating that if the project were discounted at the company's cost of capital, its net present value would be greatly reduced.

Requirements:

(a) Write a report to the directors of Anhang pic advising them how best to invest the £90000, assuming the restriction on capital to apply for one year only. Your report should address the issues raised by each of the four directors.

(17 marks)

(b) Explain why the criteria you have used in

(a) above to determine the best allocation of capital may be inappropriate if funds are rationed for a period longer than one year. (4 marks)

(c) Describe the procedures available to a company for the selection of projects when capital is rationed in more than one period.

Step by Step Answer: