You should attempt to answer this question yourself before looking up the suggested answer, which appears on

Question:

You should attempt to answer this question yourself before looking up the suggested answer, which appears on pages 866-867 . If any part of your answer is incorrect, check back carefully to make sure you understand where you went wrong.

Theta Ltd compares the performance of its subsidiaries by return on capital employed {ROCE), using the following formula:

Profit: Depreciation is calculated on a straight-line basis.

Losses on sale of assets are charged against profit in the year of the sale.

Capital employed: Net current assets- at the average value throughout the year.

Fixed assets - at original cost less accumulated depreciation as at the end of the year.

Theta Ltd, whose cost of capita l is 14% per annum, is considering acquiring Alpha Ltd, whose performance has been calculated on a similar basis to that shown above except that fixed assets are valued at original cost.

During the past year, apart from normal trading, Alpha ltd was involved in the following separate transactions:

(A) It bought equipment on 1 November 1980 (the start of its financial year) at a cost of £120000.

Resulting savings were £35 000 for the year; these are expected to continue at that level throughout the six-years expected life of the asset, after which it will have no scrap value .

(B) On 1 November 1980 it sold a piece of equipment that had cost £200 000 when bought exactly three years earlier. The expected life was four years, with no scrap value. This equipment had been making a contribution to profit of £30000 per annum before depreciation, and realized £20000 on sale.

(C) It negotiated a bank overdraft of £20000 for the year to take advantage of quick payment discounts offered by creditors; this reduced costs by £4000 per annum.

(D) To improve liquidity, it reduced stocks by an average of £25000 throughout the year. This resulted in reduced sales with a reduction of £6000 per annum contribution.

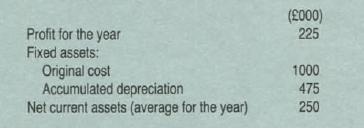

The financial posijion of Alpha Ltd for the year from 1 November 1980 to 31 October 1981 excluding the outcomes of transactions (A)-(0) above, was as follows:

You are required to:

(a) Calculate the ROCE of Alpha Ltd using its present basis of calculation:

(i) if none of the transactions (A)-(D) had taken place;

(ii) if transaction (A) had taken place but not (B), (C) or (D);

(iii) if transaction (B) had taken place but not (A), (C) or (D);

(iv) if transaction (C) had taken place but not (A), (B) or (D);

(v) if transaction (D) had taken place but not (A), (B) or (C).

(b) Calculate the ROCE as in (a)(i)-(v) above using Theta Ltd's basis of calculation.

(c) Explain briefly whether there would have been any lack of goal congruence between Theta ltd and the management of Alpha Ltd (assuming that Alpha Ltd had been acquired by Theta Ltd on 1 November 1980 and that Theta Ltd's basis of calculation was used) in respect of:

(i) transaction (A):

(ii) transaction (B).

Taxation is to be ignored.

Step by Step Answer: