G Limited, one of the subsidiaries of GAP Group p.l.c .. produces the followmg condensed data in

Question:

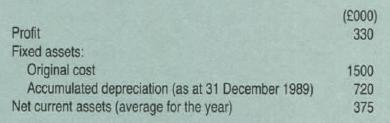

G Limited, one of the subsidiaries of GAP Group p.l.c .. produces the followmg condensed data in respect of its budgeted performance for the year to 31 December 1989:

In addition, It is considering carrying out the following separate nonroutine transactions:

A. It would offer Its customers cash discounts that would cost £8000 per annum.

This would reduce the level of its debtors by an average of £30 000 over the year. This sum would be used to increase the dividend to GAP Group p.l.c. payable at the end of the year B. It would increase its average stocks by £40000 throughout the year and reduce by that amount the dividend payable to GAP Group p.l.c. at the end of the year.

This is expected to yield an increased contribution of £15000 per annum resulting from larger sales.

C. At the start of the year it would sell for £35000 a fixed asset that originally cost £300 000 and which has been depreciated by 4/Sths of its expected life.

If not sold, this asset would be expected to earn a profit contribution of £45000 during 1989.

D. At the start of the year it would buy for £180000 plant that would achieve reductions of £52 500 per annum in revenue costs. This plant would have a life of five years, after which it would have no resale value.

The chief accountant of GAP Group p.l.c. has the task of recommending to the Group management committee whether the non-routine transactions should go ahead. The Group's investment criterion is to eam 15% DCF and where no time period is specified, four years is the period assumed.

In measuring the comparative performance of its subsidiaries, GAP Group p.l.c. uses return on capital employed (ROCE)

calculated on the following basis:

Profit: Depreciation of fixed assets is calculated on a straight-line basis. Profit or loss on sale of assets is respectively added to or deducted from operating profits in the year of sate.

Capital employed:

Fixed assets:

Net current assets:

You are required Valued at original cost less accumulated depreciation as at the end of the year.

At the average value for the year.

(a) as managing director of G Ltd, to recommend whether each of the four non-routine transactions (A to D) should independently go ahead; (8 marks)

(b) as chief accountant of GAP Group p.l.c., (i) to state whether you expect there to be goal congruence between G Limited and GAP Group p.l.c. in respect of each of the four non-routine transactions considered separately; (8 marks)

(ii) to state whether you would support a proposal to substitute a Group ROCE investment criterion in place of the existing DCF investment criterion. (4 marks)

Note: You should give supporting calculations and/or explanations In each part of your answer. Ignore taxation

Step by Step Answer: