Advanced : Compari son of the performance of two divisions ABE Ltd and KIM Ltd are two

Question:

Advanced : Compari son of the performance of two divisions ABE Ltd and KIM Ltd are two newly-established divisions of RAT pic. They operate as mdependent trading units. though some of their final product markets overlap.

Their managing directors each agreed an initial plan based on a 20% per annum charge for capital by RAT pic. The plan showed both divisions to be capable of meeting the 20% target.

During the course of the first year's operation. ABE Ltd secured a contract to supply items to LO pic, a company not within the RAT group and a direct competitor in KIM Ltd's market. KIM Ltd could have purchased the same supplies from ABE Ltd but preferred to buy from a supplier outside the RA T group.

In the first'year of operation LO pic secured a 5% increase in its share of the market at the expense of KIM Ltd, based on the previous market size. A major factor in LO pic's success was considered to be the superiority of ABE Ltd's product over those of its competitors.

KIM Ltd and LO pic were each initially expected to have a 50%

share in the final product market, the latter being KIM Ltd's sole market outlet.

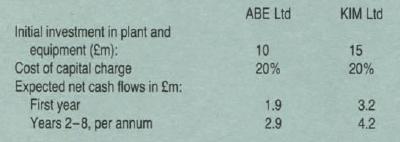

The key elements of the budgets agreed at the outset by ABE Ltd and KIM Ltd are

Assume that (1) the operating efficiencies of KIM Ltd and LO pic are broadly the same;

(2) the 5% increase in the market share made by LO pic results in a pro rata 5% increase in ABE Ltd's net cash How.

You are required to:

(a) evaluate the two divisions' expected performances as seen by RAT pic at the time of their establishment; (10 marks)

(b) evaluate the actual performance of the two divisions in their first year of operation, giving a reasoned interpretation of the outcomes; (10 marks)

(c) discuss the performance measures applicable to assessing the success or otherwise of the divisions. Identify further issues which may be deemed relevant but beyond the information given by the question.

Step by Step Answer: