In order to identify the costs incurred in carrying out a range of work to customer specification

Question:

In order to identify the costs incurred in carrying out a range of work to customer specification in its factory, a company has a job costing system. This system identifies costs directly with a job where this is possible and reasonable. In addition, production overhead costs are absorbed into the cost of jobs at the end of each month, at an actual rate per direct labour hour for each of the two production departments.

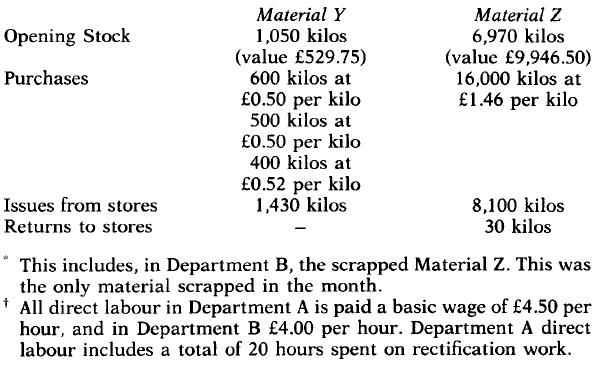

One of the jobs carried out in the factory during the month just ended was Job No. 123. The following information has been collected relating specifically to this job: 400 kilos of Material Y were issued from stores to Department A. 76 direct labour hours were worked in Department A at a basic wage of £4.50 per hour. 6 of these hours were classified as overtime at a premium of 50%. 300 kilos of Material Z were issued from stores to Department B.

Department B returned 30 kilos of Material Z to the storeroom being excess to requirements for the job. 110 direct labour hours were worked in Department B at a basic wage of £4.00 per hour. 30 of these hours were classified as overtime at a premium of 50%. All overtime worked in Department B in the month is a result of the request of a customer for early completion of another job which had been originally scheduled for completion in the month following.

Department B discovered defects in some of the work, which was returned to Department A for rectification. 3 labour hours were worked in Department A on rectification (these are additional to the 76 direct labour hours in Department A noted above). Such rectification is regarded as a normal part of the work carried out generally in the department.

Department B damaged 5 kilos of Material Z which then had to be disposed of. Such losses of material are not expected to occur.

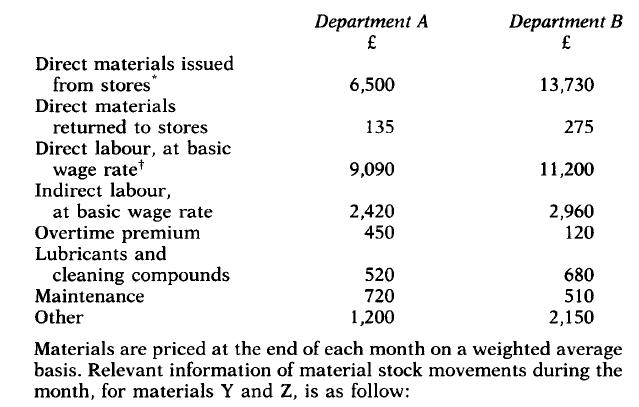

Total costs incurred during the month on all jobs in the two production departments were as follows:

Required:

(a) Prepare a list of the costs that should be assigned to Job No.

123. Provide an explanation of your treatment of each item.

(b) Discuss briefly how information concerning the cost of individual jobs can be used.

Step by Step Answer: