A small, private company is contemplating an initial public offering (IPO) in which they will sell 40,000

Question:

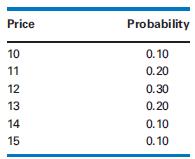

A small, private company is contemplating an initial public offering (IPO) in which they will sell 40,000 shares of stock. The price of the stock at the IPO is uncertain, with the following distribution:

In each of the next five years there is a 30 percent chance the company will fail. If it does not fail, its stock value will increase by an amount given by a lognormal distribution with a mean of 1.5 percent and a standard deviation of 0.5 percent.

a. What is the mean value of the stock at the end of five years, assuming the company does not fail in the interim?

b. What is the probability the company will still be in existence after 5 years?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Management Science The Art Of Modeling With Spreadsheets

ISBN: 1301

4th Edition

Authors: Stephen G. Powell, Kenneth R. Baker

Question Posted: