Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined

Question:

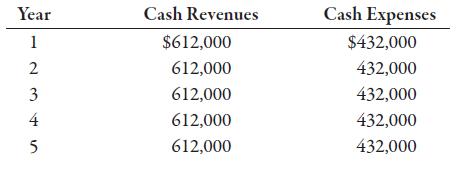

Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $460,800. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Required:

1. Compute the payback period for the NC equipment.

2. Compute the NC equipment’s ARR. Round the percentage to one decimal place.

3. Compute the investment’s NPV, assuming a required rate of return of 10%.

4. Compute the investment’s IRR.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting The Cornerstone Of Business Decision Making

ISBN: 9780357715345

8th Edition

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Question Posted: