The Chula Vista Sanitation Company is considering the purchase of a garbage truck. The $70,000 price tag

Question:

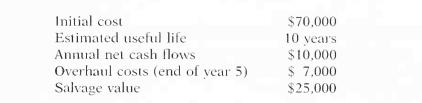

The Chula Vista Sanitation Company is considering the purchase of a garbage truck. The $70,000 price tag for a new truck would represent a major expenditure for the company. Vu Duong, owner of the company, has compiled the following estimates in trying to determine whether the garbage truck should be purchased.

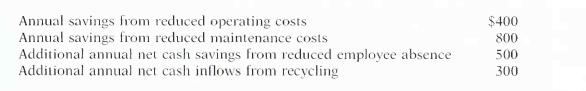

One of the company's employees is trying to convince Vu that the truck has other merits that haven't been considered in the initial estimates. First, the new truck will be more efficient, with lower maintenance and operating costs. Second, the new truck will be safer. Third, the new truck has the ability to handle recycled materials at the same time as trash, thus offering a new revenue source. Estimates of the minimum value of these benefits are the following.

The company's cost of capital is 10%.

Instructions

(a) Calculate the net present value, ignoring the additional benefits. Should the truck be purchased?

(b) Calculate the net present value, incorporating the additional benefits. Should the truck be purchased?

(c) Suppose management has been overly optimistic in the assessment of the value of the additional benefits. At a minimum, how much would the additional benefits have to be worth in order for the project to be accepted?

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9780471413653

2nd Canadian Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly