Wang Corp. is thinking about opening an ice hockey camp in Idaho. In order to start the

Question:

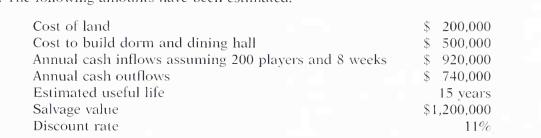

Wang Corp. is thinking about opening an ice hockey camp in Idaho. In order to start the camp the company would need to purchase land, and build two ice rinks and a dormitory-type sleeping and dining facility to house 200 players. Each year the camp would be run for 8 sessions of 1 week each. The company would hire college hockey players as coaches. The camp attendees would be male and female hockey players age 12-18. Property values in Idaho have enjoyed a steady increase in recent years. Wang Corp. expects that after using the facility for 15 years, the rinks will have to be dismantled, but the land and buildings will be worth more than they were originally purchased tor. The following amounts have been estimated.

Instructions

(a) Calculate the net present value of the project.

(b) To gauge the sensitivity of the project to these estimates, assume that if only 170 campers attend each week, revenues will be \($700,000\) and expenses will be \($670,000\). What is the net present value using these alternative estimates? Discuss your findings.

(e) Assuming the original facts, what is the net present value if the project is actually riskier than first assumed, and a 15% discount rate is more appropriate?

(d) Assume that during the first 6 years the annual net cash flows each year were only \($47,000\). At the end of the sixth year the company is running low on cash, so man- agement decides to sell the property for \($1,000,000\). What was the actual internal rate of return on the project? Explain how this return was possible given that the camp did not appear to be successful.

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9780471413653

2nd Canadian Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly