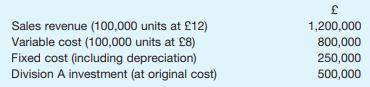

The following information applies to the planned operations of Division A of ABC Corporation for next year:

Question:

The following information applies to the planned operations of Division A of ABC Corporation for next year:

The minimum desired rate of return on investment is the cost of capital of 20 per cent a year.

The business is highly profit-conscious and delegates a considerable level of autonomy to divisional managers. As part of a procedure to review planned operations of Division A, a meeting has been convened to consider two options:

Option X Division A may sell a further 20,000 units at £11 to customers outside ABC Corporation. Variable costs per unit will be the same as budgeted, but to enable capacity to increase by 20,000 units, one extra piece of equipment will be required costing £80,000. The equipment will have a fouryear life and the business depreciates assets on a straight-line basis. No extra fixed costs will occur.

Option Y Included in the current plan of operations of Division A is the sale of 20,000 units to Division B also within ABC Corporation. A competitor of Division A, from outside ABC Corporation, has offered to supply Division B at £10 per unit. Division A intends to adopt a strategy of matching the price quoted from outside ABC Corporation to retain the order.

Required:

(a) Calculate Division A’s residual income based on 1 the original planned operation 2 Option X only added to the original plan 3 Option Y only added to the original plan and briefly interpret the results of the options as they affect Division A.

(b) Assess the implications for Division A, Division B and the ABC Corporation as a whole of Option Y, bearing in mind that if Division A does not compete on price, it will lose the 20,000 units order from Division B. Make any recommendations you consider appropriate.

Step by Step Answer:

Management Accounting For Decision Makers

ISBN: 9780273731528

6th Edition

Authors: Dr Peter Atrill, Eddie McLaney