At the beginning of 2022, Auner Company is considering whether to continue to make a product or

Question:

At the beginning of 2022, Auner Company is considering whether to continue to make a product or to buy the finished product from a supplier. The following data have been gathered:

● Expected sales (in units) for the next 4 years are as follows:

○ 2022: 40,000

○ 2023: 46,000

○ 2024: 54,000

○ 2025: 47,000

● If the company continues to make the product, it will have to invest now in some robotic equipment for $700,000. Given the rapid advances in technology, management anticipates only a $35,000 salvage value for the investment in 4 years. Management estimates that the robotic equipment will last 4 years.

● With the new robotic equipment, the variable product costs (direct materials, direct labor, and variable overhead) are expected to drop from the current $20 per unit to $14.80 per unit. The outside supplier has quoted $21 per unit. The relevant analysis is $21 – $14.80 = $6.20 per unit. The $20 current cost is irrelevant since that will not be the amount in the future.

● Of the applied annual fixed overhead, only $36,000 per year would be eliminated if Auner Company stops making the product. If the company makes the product, the company will incur extra net cash costs annually as follows: 0.7 × 36,000 = $25,200

● Annual corporate salaries are $42,000. All executives are expected to remain with the company regardless of whether Auner Company buys the product from the outside supplier.

● Auner Company’s cost of capital is 10%. Assume that, unless specified, all annual cash flows and tax payments are at year-end.

● The tax rate is 30%.

● The robotic equipment can be depreciated using an accelerated method that will result in higher tax cash savings. Tax savings are calculated by multiplying the annual allowed depreciation deductions by the tax rate. Management has calculated the cash tax savings from depreciation as follows: $67,368 in year 1, $90,720 in year 2, $28,476 in year 3, and $12,936 in year 4.

● Since the robotic equipment will be fully depreciated in 4 years, the entire salvage value will be taxed at 30%; the net cash benefit will be 0.7 × $35,000 = $24,500.

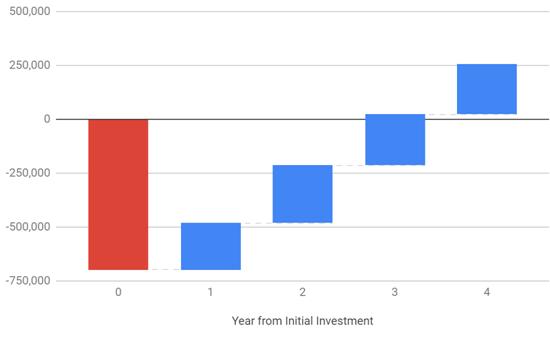

● The annual estimated product cash savings of making versus buying are:

○ Year 1: 40,000 × $6.20 × 0.7 = $173,600

○ Year 2: 46,000 × $6.20 × 0.7 = $199,640

○ Year 3: 54,000 × $6.20 × 0.7 = $234,360

○ Year 4: 47,000 × $6.20 × 0.7 = $203,980

● Management has provided the following analyses:

a. Based on the net present value, should the company make the investment in the robotic equipment?

b. What is the payback period?

c. Is the internal rate of return higher, lower, or the same as the cost of capital for this decision?

d. Discuss three intangible costs and benefits that management should consider.

e. Discuss three feasibility factors that management should consider.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope