During the first calendar quarter of 2016, Clinton Corporation is planning to manufacture a new product and

Question:

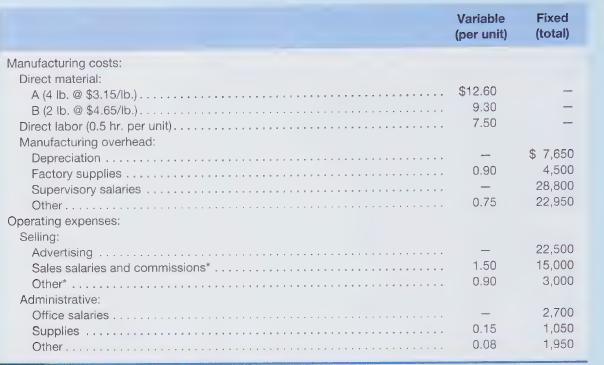

During the first calendar quarter of 2016, Clinton Corporation is planning to manufacture a new product and introduce it in two regions. Market research indicates that sales will be 6,000 units in the urban region at a unit price of \($53\) and 5,000 units in the rural region at \($48\) each. Because the sales manager expects the product to catch on, he has asked for production sufficient to generate a 4,000-unit ending inventory. The production manager has furnished the following estimates related to manufacturing costs and operating expenses:

Varies per unit sold, not per unit produced.

Required

a. Assuming that the desired ending inventories of materials A and B are 4,000 and 6,000 pounds, respectively, and that work-in-process inventories are immaterial, prepare budgets for the calendar quarter in which the new product will be introduced for each of the following operating factors:

1.Total sales

2.Production

3.Material purchases cost

4.Direct labor costs

5.Manufacturing overhead costs

6.Selling and administrative expenses

b. Using data generated in requirement (a), prepare a budgeted income statement for the calendar quarter. Assume an overall effective income tax rate of 30%.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.