Grass Roots Consulting Company (GRCC) provides a variety of services to clients. For the year 2016, it

Question:

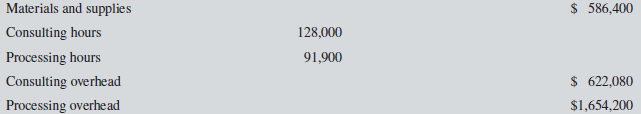

Grass Roots Consulting Company (GRCC) provides a variety of services to clients. For the year 2016, it had established the following budget (i.e., estimated amounts):

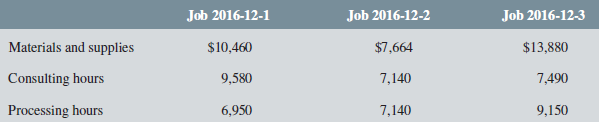

Consultants are paid at the rate of $45 per hour (there was no difference between the budgeted and the actual rates). GRCC has two types of overhead as shown above and uses two different bases to allocate overhead to client jobs (consulting hours and processing hours). During December 2016, the company started three major client jobs and incurred the following actual costs. Jobs 2016-12-1 and 2016-12-3 were completed during the month but the other job was still incomplete at month-end (there were no incomplete jobs at the start of the month).

Required:

1. Compute the total overhead costs applied during the month. Show all the steps in your computation (e.g., calculation of the predetermined overhead rate and the allocation).

2. What is the amount of total costs that GRCC would have transferred to the cost of jobs completed account during the month? (Note: This account is equivalent to the cost of goods sold account.) What is your estimate of the balance in this account at the beginning of December?

3. What is the amount of total costs that GRCC would have transferred to the jobs-in-process account during the month? (Note: This account is equivalent to a work-in-process account.) What is your estimate of the balance in this account at the end of the month assuming zero beginning balance?

4. During the month of December, GRCC debited the consulting overhead account in the amount of $123,450 and debited the processing overhead account in the amount of $413,920. Compute the balance in the overhead accounts at the end of the month after crediting the overhead accounts with the applied overhead amounts. What will you call these balances? What will be the impact on income when you close the balances in the two overhead accounts to the cost of jobs completed account?

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan