GSK Inc., accountants have developed the following data from the company's accounting records for the year ended

Question:

GSK Inc., accountants have developed the following data from the company's accounting records for the year ended November 30, 2005:

a. Purchase of plant assets, $100,000

b. Cash receipt from issuance of notes payable, $44,100

c. Payments of notes payable, $18,800

d. Cash receipt from sale of plant assets, $59,700

f. Cash receipt of dividends, $2,700

g. Payments to suppliers, $574,500

h. Interest expense and payments, $37,000

i. Payments of salaries, $104,000

j. Income tax expense and payments, $56,000

k. Depreciation expense, $27,700

l. Collections from customers, $827,100

m. Cash receipt from issuance of common stock, $66,900

n. Payment of cash dividends, $50,500

o. Cash balance: November 30, 2004-$23,800;

p. November 30, 2005-$83,500

Requirement

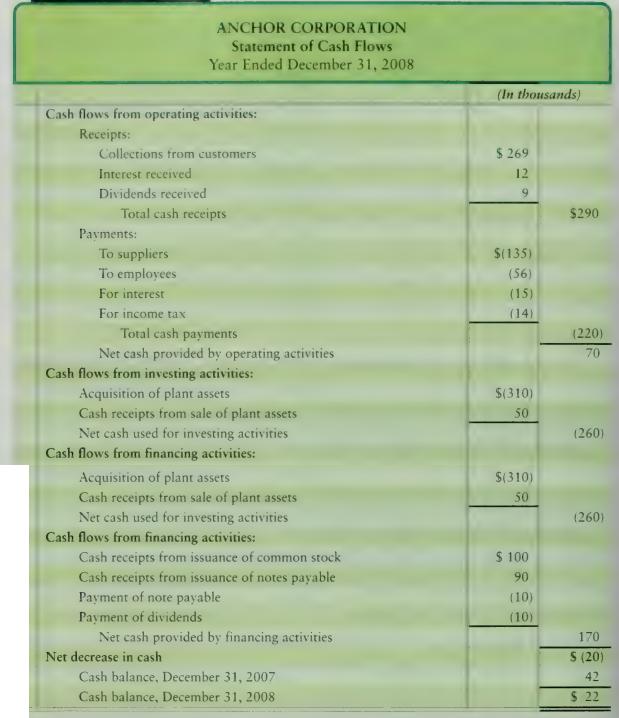

Prepare GSK's statement of cash flows for the year ended November 30, 2005. Use the direct method for cash flows from operating activities.

Follow the format of Exhibit 16A-3, but do not show amounts in thousands.

Exhibit 16A-3

Step by Step Answer: