Lincoln Company has purchased equipment for $200,000. After it is fully depreciated, the equipment will have no

Question:

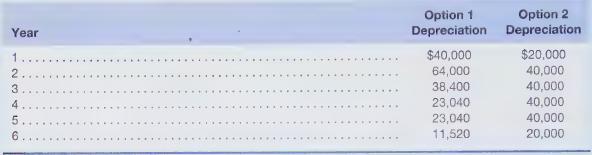

Lincoln Company has purchased equipment for $200,000. After it is fully depreciated, the equipment will have no salvage value. Lincoln may select either of the following depreciation schedules for tax purposes:

Assuming a 40% tax rate and a 12% desired annual return, compute the total present value of the tax savings provided by these alternative depreciation tax shields. Which depreciation schedule would be more attractive to Lincoln?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.

Question Posted: