Over the past several years, Claire Jackson, CEO and founder of Easy Learning (EL), has been working

Question:

Over the past several years, Claire Jackson, CEO and founder of Easy Learning (EL), has been working to expand operations outside of Canada. In particular, she has placed two longtime, trusted managers in Paris and Buenos Aires in order to develop the European and South American markets. Competition is Jess fierce in these parts of the world and the supply of skilled technical and education staff is in good supply.

Claire was deeply involved in the development and expansion activities for the first few years. Now that the new divisions are up and running, she has decided to decentralize by creating a European and a South American division and putting their current local managers in charge.

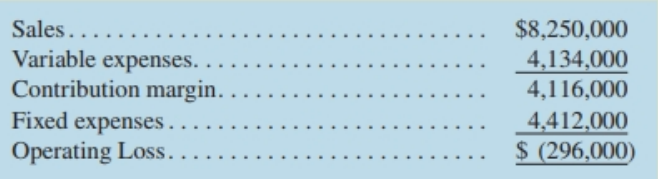

After the first full year of operations under the decentralized structure, the contribution format in-come statement for the company as a whole is as follows:

When the divisions were created, EL invested heavily in operating assets to set up and organize the new operations. Therefore, Claire decided to make these divisions investment centres and to require each division to generate a return on investment on operating assets of at least 12%, which is the company's minimum required rate of return. The divisional managers' bonuses are also based on ROI. Average operating assets of the European division are $1,000,000 and $485,000 for the South American division.

Claire is concerned that the company has incurred an operating loss for die first time this year, although she is not completely surprised given her decision to expand. She would like to isolate the problem and decide how to respond. She is concerned that one problem may be her Jack of direct supervision of the newly created divisions.

Required:

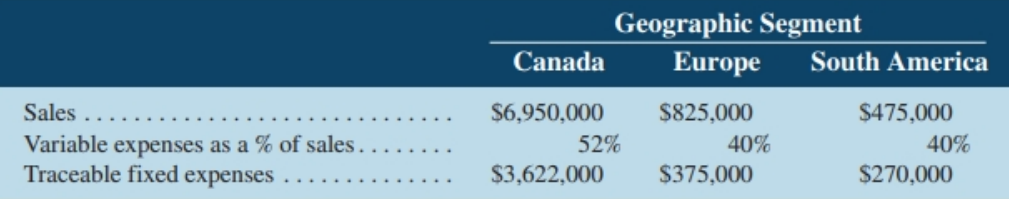

1. Use the following information to help the CEO better understand the profitability of each geographic segment. What does your analysis suggest she should do?

2. Calculate the ROI for each of the European and South American divisions. Will the divisional managers receive a bonus this year? If not, what can the CEO suggest to help these managers raise their ROI next year?

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby