O-wen Snowboard Company designs and manufactures snowboards. The boards are assembled in the companys Assembly Department in

Question:

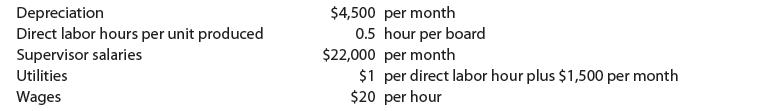

O-wen Snowboard Company designs and manufactures snowboards. The boards are assembled in the company’s Assembly Department in Colorado. Information for the Assembly Department is as follows:

Prepare a flexible budget for the Assembly Department for 3,000, 4,000, and 5,000 boards in August 20Y1.

Transcribed Image Text:

Depreciation Direct labor hours per unit produced Supervisor salaries Utilities Wages $4,500 per month 0.5 hour per board $22,000 per month $1 per direct labor hour plus $1,500 per month $20 per hour

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Units of production Variable costs Direct labor Utilities Total variable costs Fixed costs O...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Financial And Managerial Accounting

ISBN: 9781337902663

15th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William B. Tayler

Question Posted:

Students also viewed these Business questions

-

A company is adding an additional machine to increase its operating capacity for the next 12 years. As utilization of the new machine ramps up, the company will see changes in revenues, operating...

-

Fountainhead Company manufactures two types of display boards that are sold to office supply stores. One board is hard-finished marking board that can be written on with a water-soluble felt-tip...

-

In August 2010, Wentao Chen, manager of Danshui Plant No. 2 in southern China, was anxious. The plant was in the third month of a 12-month contract to assemble the Apple iPhone 4. The contract called...

-

The Eldorado Corporation's controller prepares adjusting entries only at the end of the fiscal year. The following adjusting entries were prepared on December 31, 2011: Additional information: 1. The...

-

There are two other stereoisomeric tartaric acids. Write their Fischer projections, and specify the configuration at their stereogenic centers.

-

Describe the main sources of debt financing: bank loans, leases, commercial paper and debt securities. AppendixLO1

-

Plot the data and describe what you see. What does it mean and how would you use the information from the plot to help you develop a forecast? LO.1

-

A large wrecking ball is held in place by two light steel cables (Fig. 5.43). If the mass m of the wrecking ball is 4090 kg, what are (a) The tension TB in the cable that makes an angle of 40°...

-

When comparing the direct write-off and allowance methods, which of the following statements applies to the direct write-off method? a. An allowance account is used. b. Primary users are large...

-

Variable costs are $70 per unit and fixed costs are $150,000. Sales are estimated to be 10,000 units. How much would absorption costing operating income differ between a plan to produce 10,000 units...

-

The beginning inventory consists of 6,000 units, all of which are sold during the period. The beginning inventory fixed costs are $20 per unit, and the variable costs per unit are $90 per unit....

-

The sample data for Exercise 17.29 are shown here. Run an AOV and draw conclusions. Use α = .05. Analysis Locution 1 15.2 16.8 17.5 162 13.1 13.8 12.6 12.9 17.5 17 16.7 165 183 184 18.6...

-

The following information appears in the records of Poco Corporation at year-end: a. Calculate the amount of retained earnings at year-end. b. If the amount of the retained earnings at the beginning...

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B D Beginning Assets... $38,000 $22,000 $38,000 ? Liabilities.. 22,000 15,000...

-

On December 31, John Bush completed his first year as a financial planner. The following data are available from his accounting records: a. Compute John's net income for the year just ended using the...

-

Statement of Stockholders' Equity and Balance Sheet The following is balance sheet information for Flush Janitorial Service, Inc., at the end of 2019 and 2018: Required a. Prepare a balance sheet as...

-

Petty Corporation started business on January 1, 2019. The following information was compiled by Petty's accountant on December 31, 2019: Required a. You have been asked to assist the accountant for...

-

Find intervals containing solutions to the following equations. a. x 3x = 0 b. 4x2 ex = 0 c. x3 2x2 4x + 2 = 0 d. x3 + 4.001x2 + 4.002x + 1.101 = 0

-

Explain the buyers position in a typical negotiation for a business. Explain the sellers position. What tips would you offer a buyer about to begin negotiating the purchase of a business?

-

Identify the following costs as direct materials (DM), direct labor (DL), or factory overhead (FO) for an automobile manufacture. a. Paper used in the magazine b. Maintenance on printing machines c....

-

Identify the following costs as direct materials (DM), direct labor (DL), or factory overhead (FO) for an automobile manufacture. a. Paper used in the magazine b. Maintenance on printing machines c....

-

Identify the following costs as a prime cost (P), conversion cost (C), or both (B) for an automobile manufacture. a. Steel b. Wages of employees that operate painting equipment c. Oil used for...

-

Kirk and Spock formed the Enterprise Company in 2010 as equal owners. Kirk contributed land held an investment ($50,000 basis; $100,000 FMV), and Spock contributed $100,000 cash. The land was used in...

-

Pedro lives in Puerto Rico and had a net taxable income of $35,000 for the year 20X1. Your gross income totals $60,000. What is Pedro's regular income tax for 20X1? a.$4,620 b.$4,900 c.$2,318 d.$2,520

-

The change in cash is equal to the change in liabilities less the change in equity plus the change in noncash assets. O True False

Study smarter with the SolutionInn App