Question:

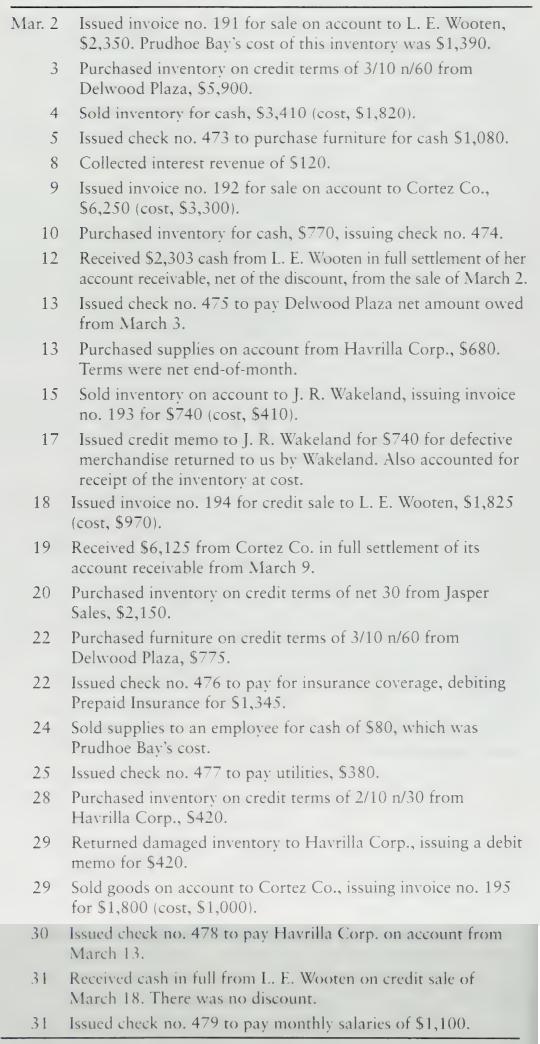

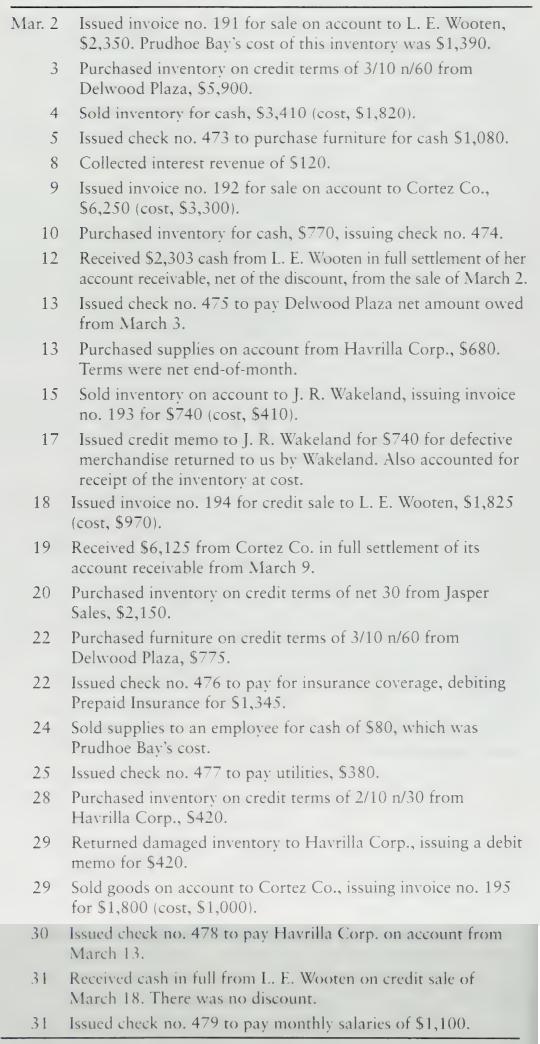

Prudhoe Bay Co. uses the perpetual inventory system and makes all credit sales on terms of \(2 / 10 \mathrm{n} / 30\). During March, Prudhoe Bay Co. completed these transactions:

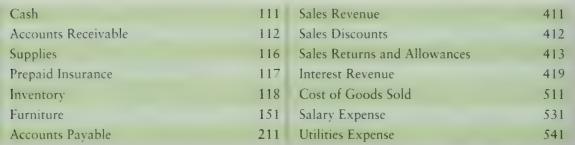

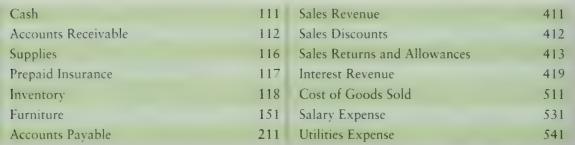

Requirements 1. Open four-column general ledger accounts using Prudhoe Bay Co.'s account numbers that follow. (pp. 361-369)

2. Open these accounts in the subsidiary ledgers. Accounts receivable ledger: Cortez Co., J. R. Wakeland, and L. E. Wooten. Accounts payable ledger: Delwood Plaza, Havrilla Corp., and Jasper Sales.

3. Enter the transactions in a sales journal (page 8 ), a cash receipts journal (page 3), a purchases journal (page 6), a cash payments journal (page 9), and a general journal (page 4), as appropriate.

4. Post daily to the accounts receivable ledger and to the accounts payable ledger. On March 31, post to the general ledger.

5. Total each column of the special journals. Show that total debits equal total credits in each special journal.

6. Balance the total of the customer account balances in the accounts receivable ledger against Accounts Receivable in the general ledger. Do the same for the accounts payable ledger and Accounts Payable in the general ledger.

Transcribed Image Text:

Mar. 2 Issued invoice no. 191 for sale on account to L. E. Wooten, $2,350. Prudhoe Bay's cost of this inventory was $1,390. 3 Purchased inventory on credit terms of 3/10 n/60 from Delwood Plaza, $5,900. 4 Sold inventory for cash, $3,410 (cost, $1,820). 5 Issued check no. 473 to purchase furniture for cash $1,080. 8 Collected interest revenue of $120. 9 Issued invoice no. 192 for sale on account to Cortez Co., $6,250 (cost, $3,300). 10 Purchased inventory for cash, $770, issuing check no. 474. 12 Received $2,303 cash from L. E. Wooten in full settlement of her account receivable, net of the discount, from the sale of March 2. 13 Issued check no. 475 to pay Delwood Plaza net amount owed from March 3. 13 Purchased supplies on account from Havrilla Corp., $680. Terms were net end-of-month. 15 Sold inventory on account to J. R. Wakeland, issuing invoice no. 193 for $740 (cost, $410). 17 Issued credit memo to J. R. Wakeland for $740 for defective merchandise returned to us by Wakeland. Also accounted for receipt of the inventory at cost. 18 Issued invoice no. 194 for credit sale to L. E. Wooten, $1,825 (cost, $970). 19 Received $6,125 from Cortez Co. in full settlement of its account receivable from March 9. 20 Purchased inventory on credit terms of net 30 from Jasper Sales, $2,150. 22 Purchased furniture on credit terms of 3/10 n/60 from Delwood Plaza, $775. 22 Issued check no. 476 to pay for insurance coverage, debiting Prepaid Insurance for $1,345. 24 Sold supplies to an employee for cash of $80, which was Prudhoe Bay's cost. 25 Issued check no. 477 to pay utilities, $380. 28 Purchased inventory on credit terms of 2/10 n/30 from Havrilla Corp., S420. 29 Returned damaged inventory to Havrilla Corp., issuing a debit memo for $420. 29 Sold goods on account to Cortez Co., issuing invoice no. 195 for $1,800 (cost, $1,000). 30 Issued check no. 478 to pay Havrilla Corp. on account from March 13. 31 Received cash in full from L. E. Wooten on credit sale of March 18. There was no discount. 31 Issued check no. 479 to pay monthly salaries of $1,100.