Question: Runway Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Each project requires an investment of

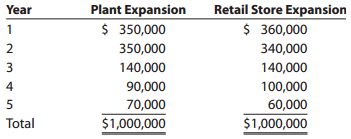

Runway Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows:

Each project requires an investment of $700,000. A rate of 15% has been selected for the net present value analysis.

1. Compute the following for each product:

a. Cash payback period.

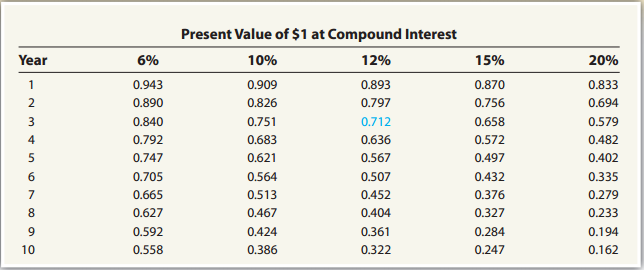

b. The net present value. Use the present value of $1 table appearing in this chapter (Exhibit 1).

2. Prepare a brief report advising management on the relative merits of each project.

Exhibit 1:

Plant Expansion $ 350,000 350,000 140,000 Retail Store Expansion Year $ 360,000 340,000 3 100,000 90,000 70,000 Total $1,000,000 $1,000,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 9. 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

1 a Cash payback period for both projects 2 years the year in which accumulated ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1737_606175693ad95_712809.xlsx

300 KBs Excel File