The adjusted trial balance of Job Link Employment Service is incomplete. Enter the adjustment amounts directly in

Question:

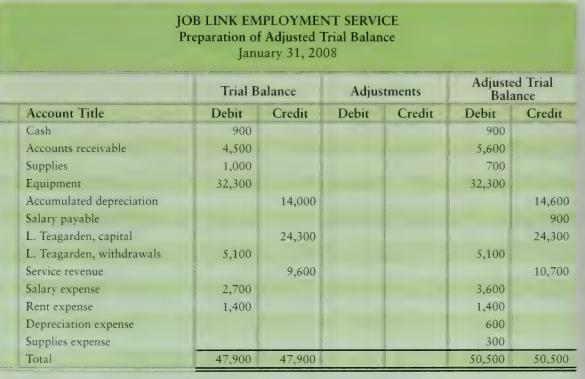

The adjusted trial balance of Job Link Employment Service is incomplete. Enter the adjustment amounts directly in the Adjustments columns below.

Transcribed Image Text:

JOB LINK EMPLOYMENT SERVICE Preparation of Adjusted Trial Balance January 31, 2008 Trial Balance Adjustments Account Title Cash Debit Credit Debit Credit 900 Accounts receivable 4,500 Adjusted Trial Balance Debit Credit 900 5,600 Supplies 1,000 700 Equipment 32,300 32,300 Accumulated depreciation 14,000 14,600 Salary payable 900 L. Teagarden, capital 24,300 24,300 L. Teagarden, withdrawals 5,100 5,100 Service revenue 9,600 10,700 Salary expense 2,700 3,600 Rent expense 1,400. 1,400 Depreciation expense 600 Supplies expense 300 Total 47,900 47,900 50.500 50.500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Shubhradeep Maity

I am an experienced and talented freelance writer passionate about creating high-quality content. I have over five years of experience working in the field and have collaborated with several renowned companies and clients in the SaaS industry.

At Herman LLC, an online collective of writers, I generated 1,000+ views on my content and created journal content for 100+ clients on finance topics. My efforts led to a 60% increase in customer engagement for finance clients through revamping website pages and email interaction.

Previously, at Gerhold, a data management platform using blockchain, I wrote and published over 50 articles on topics such as Business Finance, Scalability, and Financial Security. I managed four writing projects concurrently and increased the average salary per page from $4 to $7 in three months.

In my previous role at Bernier, I created content for 40+ clients within the finance industry, increasing sales by up to 40%.

I am an accomplished writer with a track record of delivering high-quality content on time and within budget. I am dedicated to helping my clients achieve their goals and providing exceptional results.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Q1. Let u= (, 3), v = (2, 32) V = R and & R. Then we define addition and scalar multiplication on Vas; u + v = (x+y-1,22 + y2-1) and a.u = (ay, ). (i). Compute, u+vand k.u, if u =(-1,3), v= (2,0)...

-

The adjusted trial balance of Jobs4U Employment Service, Inc., follows but is incomplete. Requirements 1. Calculate and enter the adjustment amounts directly in the missing Adjustments columns. 2....

-

The adjusted trial balance of Jobs4U Employment Service follows but is incomplete. Requirements 1. Calculate and enter the adjustment amounts directly in the missing Adjustments columns. 2. Prepare...

-

Parent Ltd owns 80% of Subsidiary Ltd. In the financial year ended 30 June 20X2, Subsidiary Ltd sold inventory to Parent Ltd. Details regarding the transaction are as follows: Cost to Subsidiary to...

-

Let A be a 3 3 matrix and let b = 3a1 + a2 + 4a3 Will the system Ax = b be consistent? Explain.

-

In Exercises 35 through 42, the slope f'(x) at each point (x, y) on a curve y = f(x) is given along with a particular point (a, b) on the curve. Use this information to find f(x). f'(x) = 4x + 1; (1,...

-

A researcher initially plans to take an SRS of size n from a population that has mean 80 and standard deviation 20. If he were to double his sample size (to 2n), the standard deviation of the...

-

What changes produce a sell signal in the Dow Theory and Barrons confidence index?

-

c. Advise LO.2 Selma operates a contractor's supply store. She maintains her books using the cash method. At the end of 2021, her accountant computes her accrual basis income that is used on her tax...

-

Lake Air Interiors began the year with capital of \($20,000.\) On July 12, Cynthia Norcross (the owner) invested \($12,000\) cash in the business. On September 26, Xorcross transferred to the company...

-

Merry Maids, the cleaning service, started the preparation of its adjusted trial balance as follows: During the six months ended June 30, 2007, Merry Maids: a. Used supplies of \(\$ 1,500\). b. Used...

-

Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2011: Mar. 17 Accounts receivable of $1,700 were written off as...

-

3. Now the bomb arrives. Please catch fx,y(x, y) = = cx cx - dy, where 0 < x < 1, 0 y x. 13 a) Please find coefficients c, d such that cd= 8 b) Please find fx(x) and fy (y). Are X and Y independent?...

-

At March 31, account balances after adjustments for Vizzini Cinema are as follows: Account Balances Accounts Cash Supplies Equipment (After Adjustment) $11,000 4,000 50,000 Accumulated...

-

2. "A student holds a thin aluminum pie pan horizontally 2 m above the ground and releases it. Using a motion detector, she obtains the graph shown in Figure P3.12. Based on her measurements, (a)...

-

Mark has two sticks, 25 inches, and 20 inches. If he places them end-to-end perpendicularly, what two acute angles would be formed when he added the hypotenuse?

-

A wedding website states that the average cost of a wedding is $29,205. One concerned bride hopes that the average is less than reported. To see if her hope is correct, she surveys 36 recently...

-

An investment under consideration has a payback of five years and a cost of $ 1,200. If the required return is 20 percent, what is the worst- case NPV? Explain fully. Source: R. Watts.

-

D Which of the following is considered part of the Controlling activity of managerial accounting? O Choosing to purchase raw materials from one supplier versus another O Choosing the allocation base...

-

Need help finishing consolidating this... show work please Additional Information: Intercompany Sales: The four companies have intercompany transactions involving inventory. During the year, the...

-

11 (1 point) If an account receivable of $900 charged off in 20X1 under the direct charge-off method is recovered in 20X2, in what way does accounting for the recovery differ from that used if the...

-

BIG Motors purchased a new vehicle costing P2,200,000 on May 1, 2021. It estimates the useful life of the said vehicle to be 5 years with a salvage value of P130,000. Identify the required below. 1....

Study smarter with the SolutionInn App