The budget director of Birding Homes & Feeders Inc., with the assistance of the controller, treasurer, production

Question:

The budget director of Birding Homes & Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January:

a. Estimated sales for January:

Bird house . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,000 units at $25 per unit

Bird feeder . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,000 units at $15 per unit

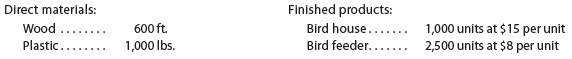

b. Estimated inventories at January 1:

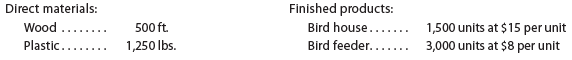

c. Desired inventories at January 31:

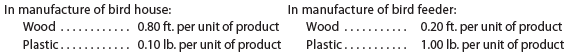

d. Direct materials used in production:

e. Anticipated cost of purchases and beginning and ending inventory of direct materials:

Wood . . . . . . . . . . . . $2.50 per ft.

Plastic . . . . . . . . . . . $0.80 per lb.

f. Direct labor requirements:

Bird house:

Fabrication Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.40 hr. at $18 per hr.

Assembly Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.20 hr. at $12 per hr.

Bird feeder:

Fabrication Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.25 hr. at $18 per hr.

Assembly Department . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.10 hr. at $12 per hr.

g. Estimated factory overhead costs for January:

Indirect factory wages........................................................................$40,000

Power and light...................................................................................$10,000

Depreciation of plant and equipment...............................................20,000

Insurance and property tax..................................................................5,000

h. Estimated operating expenses for January:

Sales salaries expense.....................................................................$125,000

Advertising expense.............................................................................80,000

Office salaries expense........................................................................40,000

Depreciation expense—office equipment..........................................4,000

Travel expense—selling......................................................................25,000

Office supplies expense........................................................................2,500

Miscellaneous administrative expense...............................................3,500

i. Estimated other revenue and expense for January:

Interest revenue......................................................................$4,540

Interest expense........................................................................3,000

j. Estimated tax rate: 25%

Instructions

1. Prepare a sales budget for January.

2. Prepare a production budget for January.

3. Prepare a direct materials purchases budget for January.

4. Prepare a direct labor cost budget for January.

5. Prepare a factory overhead cost budget for January.

6. Prepare a cost of goods sold budget for January. Work in process at the beginning of January is estimated to be $9,000, and work in process at the end of January is estimated to be $10,500.

7. Prepare a selling and administrative expenses budget for January.

8. Prepare a budgeted income statement for January.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer: