Question: Top managers at CalPaks are considering dropping the rolling backpacks product line. Company accountants have prepared the following analysis to help make this decision: Total

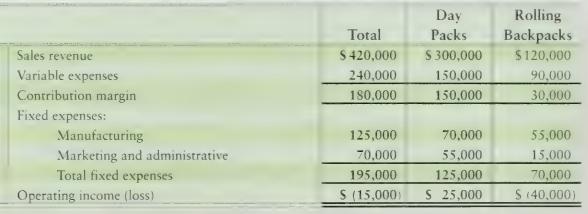

Top managers at CalPaks are considering dropping the rolling backpacks product line. Company accountants have prepared the following analysis to help make this decision:

Total fixed expenses will not change if the company stops selling rolling backpacks.

Prepare an incremental analysis to show the impact on operating income if CalPaks drops the rolling backpacks line. Should CalPaks drop the product line? Will dropping the rolling backpacks line add \(\$ 40,000\) to operating income? Explain.

Sales revenue Variable expenses Contribution margin Fixed expenses: Manufacturing Marketing and administrative Total fixed expenses Operating income (loss) Day Rolling Total Packs Backpacks $420,000 $ 300,000 $120,000 240,000 150,000 90,000 180,000 150,000 30,000 125,000 70.000 55,000 70,000 55,000 15,000 195,000 125,000 S (15,000) $ 25,000 70,000 $ (40,000)

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts