A large real estate firm has half a million dollars which it wishes to invest in urban

Question:

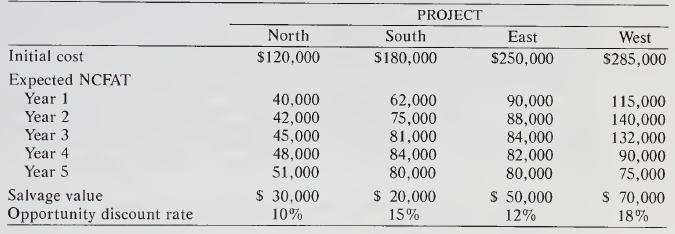

A large real estate firm has half a million dollars which it wishes to invest in urban housing development projects. The available opportunities have been carefully evaluated and the four most promising projects have been thoroughly examined, with cost and demand estimates being supplied by a reliable group of consultants at a cost of $10,000. The projects are known as North, South, East, and West because of their locations relative to the firm’s main office. The relevant details are as follows:

Each project would be developed in five yearly stages, with all accounts being paid and all revenues being received from sales on the last day of each year. The initial costs shown refer to the cost of purchasing each tract of land, and this must be paid before any activity can begin.

(a) Calculate the expected net present value of each project and rank the projects in descending order.

(b) Calculate the profitability index for each project and rank them in descending order.

(c) Which projects should be undertaken in order to maximize the net present value of the funds available?

(d) What is the maximum net present value of the funds available? Explain.

Step by Step Answer: