You have recently been hired as an assistant investment analyst in a small corporation which promotes new

Question:

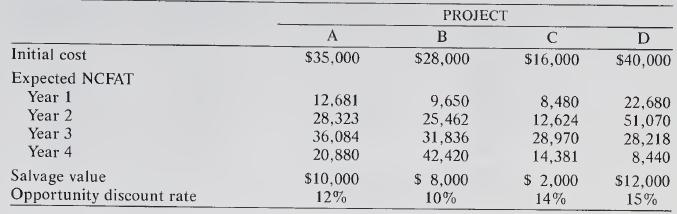

You have recently been hired as an assistant investment analyst in a small corporation which promotes new products and inventions. Your boss has asked you to evaluate and rank four potential investment projects. He tells you that the capital budget for the year is $105,000 and that anything left over can be invested in government bonds at 8.5 percent per annum. The details of the four projects are as shown on page 591.

Your boss tells you that it is “company policy” to consider the expected net cash flow stream up to and including the fourth year only. He says to treat flows as if they were to arrive in lump sum on the last day of each year.

(a) Calculate the expected net present value of each project, and rank the projects in descend¬ ing order.

(b) Calculate the profitability index for each project and rank them in descending order.

(c) Which projects do you recommend should be implemented if your boss wishes to maximize the expected net present value of the capital budget?

(d) What is the maximum expected net present value of the capital budget? Explain.

Step by Step Answer: