You are the newly hired vice-president of design and marketing at Bender Fender Automotive Design and Aerodynamics,

Question:

You are the newly hired vice-president of design and marketing at Bender Fender Automotive Design and Aerodynamics, Inc. Bender Fender has grown substantially in the past few years as a result of the quest by all automobile manufacturers for greater aerodynamic efficiency. Bender Fender is one of only about a dozen firms in the world with their own wind tunnels and the capability to design and build full-scale models for the world’s automobile producers. These producers regularly contract out for new designs, and some of these designs eventually go into production.

The Ford Motor Company has called for tenders for a new design. The specifications are simple: the car must seat five passengers in comfort, use existing mechanical components for the most part, and have a coefficient of drag (Cx) less than 0.20. This is an exceptionally low Cx figure for a five-passenger car, and its design represents a real challenge. Undeterred by challenges, and with you as his right-hand person, Mr. Bender tells you to prepare a bid for the Ford contract. With the aid of the company accountant, you derive the following cost data:

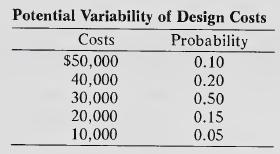

Design costs will only be incurred if the contract is won. These costs are uncertain, and are shown in the table at their most likely value. Cost overruns or underruns are frequent, how¬ ever, with the former being more likely. The accountant helps you construct the probability distribution of design costs from past experience, as follows:

The design and production of the model is expected to take a full year, with cost outlays being distributed more or less uniformly over the year. The firm’s opportunity discount rate is 15 percent. Payment for the contract (the bid price) will be received in lump sum at the end of the first year. The firm’s bidding practice over the past few years has been to mark up incremental costs by 30 percent, with adjustments to the markup rate to reflect current capacity utilization, profitability, foreseen future costs and revenues, opportunity costs, and so on. Mr. Bender says to bid at 30 percent over incremental costs this time because the situation is normal and there are no extraordinary features that are obvious to him.

You have been reading the trade association magazine, however, and know that if you win this contract and successfully design a car with Cx less than 0.20, you will be considered for the Automotive Designer of the Year award. To win this award would be a great boost to your career, and you think the probability of winning the award is 0.80 if you can achieve the specifications required by Ford. Moreover, if you win the award, you feel sure it will bring Bender Fender additional business in the following year, as indicated below. Assume that all cash flows relating to this future business are received and disbursed at the end of the second year.

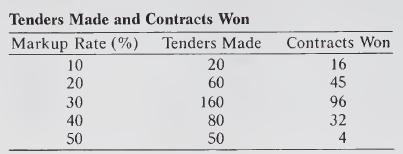

You ask Mr. Bender for the firm’s records concerning past contracts tendered for. After weeding out those not related to automotive design, you have the following data:

(a) Calculate the minimum bid price, such that the expected present value of contribution from the contract would be zero, if won.

(b) Calculate the expected present value of contribution at each of the bid prices suggested by the markup rates shown above, and find the price which maximizes the EPVC.

(c) Consider all the issues, assumptions, and qualifications which underlie your analysis, and choose your bid price.

Step by Step Answer: