Prentice Plumbing and Pipes Limited specializes in household plumbing installation and re pairs. The sales manager received

Question:

Prentice Plumbing and Pipes Limited specializes in household plumbing installation and re¬ pairs. The sales manager received a call this morning to provide a written price quotation for the installation of the entire plumbing system in a new house being built by the owner (with the aid of contractors for the plumbing and electrical work). The owner has called for three or four quotes on each of the plumbing and electrical jobs.

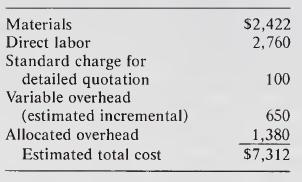

The sales manager, David Katz, sent his estimator to the job site and has since received the following cost estimate:

Prentice’s usual pricing policy is to mark up its estimated (full) costs by 12.5 percent to 25 percent, depending upon

(a) how badly it needs the work to avoid employee layoffs,

(b) whether or not the buyer is considering one or more other quotations, and

(c) whether or not it expects the job to provide an introduction to a client who will have more jobs to be done in the future. The present demand situation for Prentice Plumbing and Pipes is quite pleasing, although Prentice does have sufficient operating capacity to handle the job under consideration. Mr. Katz intends to quote $8,775, which is approximately equal to full cost plus 20 percent markup.

Suppose that you have ascertained that the expected value of the bid price for each of the three other firms also submitting quotes on this job is $8,592, with a standard deviation of $1,032. Assuming the probability distribution of each rival’s bid price to be normally distrib¬ uted around the mean (expected value), find the bid price that maximizes the expected value of the contribution to overheads and profits for Prentice.

(a) Is the sales manager’s price quote close enough for maximization of expected profits?

(b) What would you advise Mr. Katz, and why?

(c) Discuss the applicability of a cost-plus-fee bid on this contract.

Step by Step Answer: