8-2. Demand and Supply of Syndicated Bank Loans In 1998, the Syndicated Bank Loan market (defined as

Question:

8-2. Demand and Supply of Syndicated Bank Loans In 1998, the Syndicated Bank Loan market (defined as loans having more than two bank lenders) was a vast and cheap source of debt financing for U.S. corporations. This market was characterized by a large number of financial institutions that aggressively committed capital to debt issuers as a way to build market share and increase earnings.

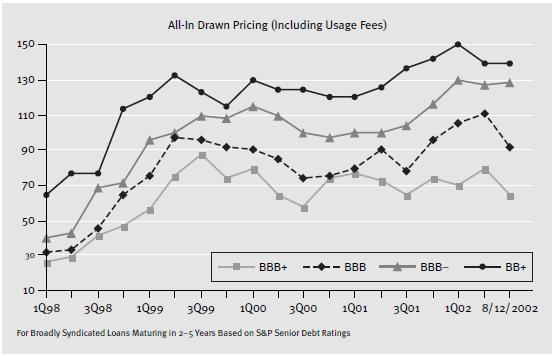

Over the next three years, however, syndicated loan prices increased dramatically while the quantity of these loans declined. The price increase, measured as a markup over the cost of funds or LIBOR (London Interbank Offered Rate), is illustrated in the figure labeled ‘‘All-In Drawn Pricing.’’ For example, the price to BBB-rated companies rose from 37.5 basis points in 1998 to approximately 129 basis points in 2002. This is a 244% increase in the price or spread. Explain these changes using shifts in demand and/or supply.

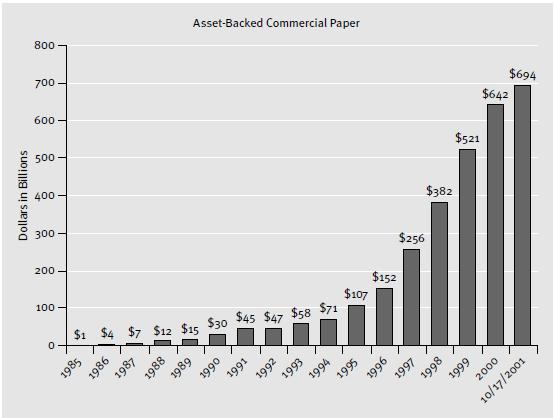

Over the same time period, in a related lending market, asset-backed commercial paper, we see a huge quantity increase as shown in the ‘‘Asset-Backed Commercial Paper’’ graph. Did prices for these loans increase or decrease? Justify your answer using shifts in supply and demand curves.

Step by Step Answer:

Managerial Economics A Problem Solving Approach

ISBN: 9780324359817

1st Edition

Authors: Luke M. Froeb, Brian T. McCann