Suppose that each Libor rate is driven by a separate Wiener process dL i (t) =

Question:

Suppose that each Libor rate is driven by a separate Wiener process dLi (t) = σi (Li(t),t) dWit (under the measure with numeraire being the discount bond maturing at the pay date of the Libor rate) with correlation structure given by dWit dWit = ρij (t)dt. Using the same approach as in Section 9.1.1, find the drift of each Libor rate under the terminal measure.

Section 9.1.1

Transcribed Image Text:

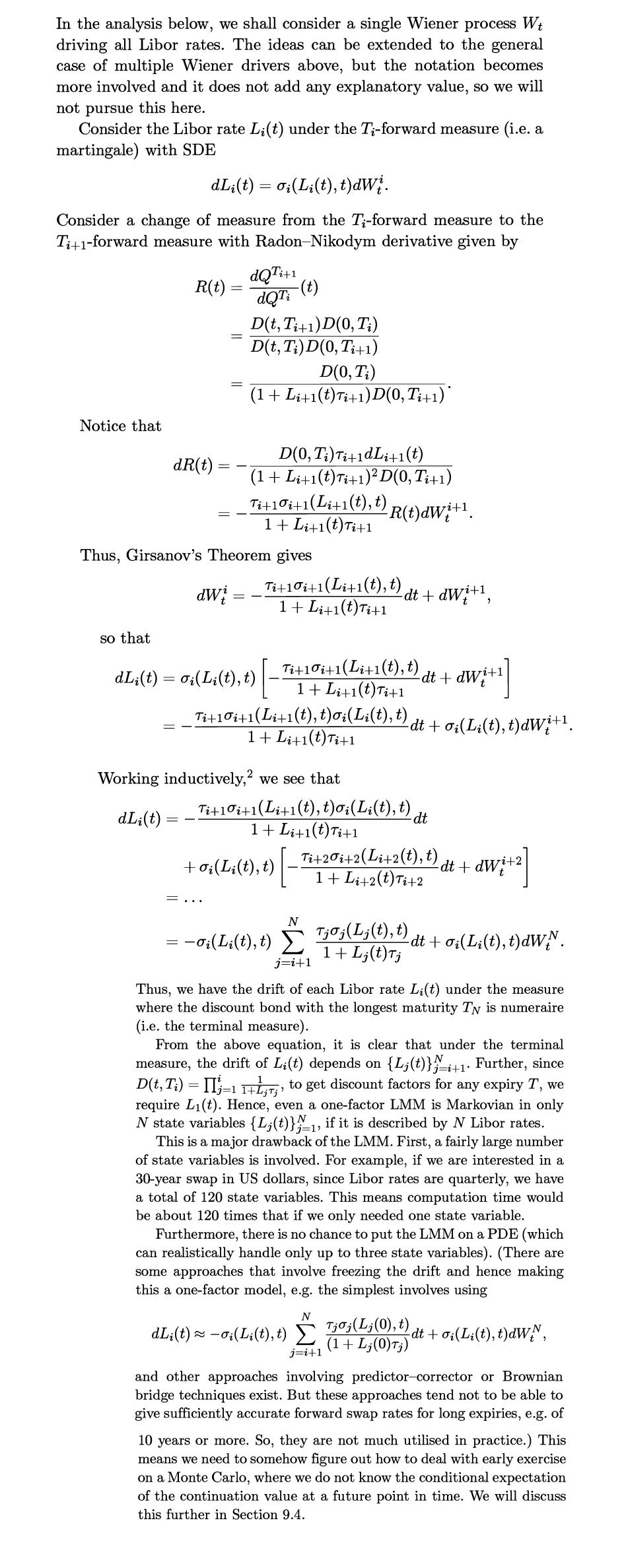

In the analysis below, we shall consider a single Wiener process Wt driving all Libor rates. The ideas can be extended to the general case of multiple Wiener drivers above, but the notation becomes more involved and it does not add any explanatory value, so we will not pursue this here. Consider the Libor rate Li(t) under the Ti-forward measure (i.e. a martingale) with SDE dL;(t) = ơi(Li(t),t)dW. Consider a change of measure from the T-forward measure to the Ti+1-forward measure with Radon Nikodym derivative given by Notice that R(t) dR(t) = dWi = dQTi+1 dQTi -(t) D(t,Ti+1)D(0,T) D(t, Ti) D(0, Ti+1) D(0, T;) (1 + Li+1(t) Ti+1)D(0, Ti+1)* Thus, Girsanov's Theorem gives =... D(0, Ti) Ti+1dLi+1(t) (1 + Li+1(t) Ti+1)²D(0, Ti+1) _Ti+1®i+1(L;+1(t),t) -R(t)dWi+¹ 1 + Li+1(t) Ti+1 so that dL;(t) = 0;(Li(t),t) |- _Ti+1i+1(Li+1(t),t), 1 + Li+1(t) Ti+1 Ti+10i+1(Li+1(t),t) 1+ Li+1(t) Ti+1 _Ti+1i+1(Li+1(t),t) :(Li(t), t) 1+ Li+1(t) Ti+1 Working inductively, 2 we see that dLi(t) + oi(Li(t), t) |- dt + dwi+¹, Ti+1i+1(Li+1(t),t)ơi(Li(t),t) 1+ Li+1(t) Ti+1 N = -σi(Li(t), t) Σ j=i+1 -dt + oi(Li(t), t)dWi+¹. -dt + dWi+¹ Ti+20i+2(Li+2(t), t) 1+ Li+2(t) Ti+2 Tjøj(Lj(t), t) 1 + Lj(t) Tj N dLi(t) ≈ −oi(Li(t), t) Σ j=i+1 - dt -dt + dWi+² Wi+2] -dt + oi(Li(t), t)dWN. Thus, we have the drift of each Libor rate Li(t) under the measure where the discount bond with the longest maturity Ty is numeraire (i.e. the terminal measure). From the above equation, it is clear that under the terminal measure, the drift of Li(t) depends on {Lj(t)}+1. Further, since D(t, T;) = I=1 1+L;7;, to get discount factors for any expiry T, we require L₁(t). Hence, even a one-factor LMM is Markovian in only N state variables (L;(t)}1, if it is described by N Libor rates. N This is a major drawback of the LMM. First, a fairly large number of state variables is involved. For example, if we are interested in a 30-year swap in US dollars, since Libor rates are quarterly, we have a total of 120 state variables. This means computation time would be about 120 times that if we only needed one state variable. Furthermore, there is no chance to put the LMM on a PDE (which can realistically handle only up to three state variables). (There are some approaches that involve freezing the drift and hence making this a one-factor model, e.g. the simplest involves using TjOj(Lj(0), t) dt + oi (Li(t), t)dWN, (1 + Lj (0) Tj) and other approaches involving predictor-corrector or Brownian bridge techniques exist. But these approaches tend not to be able to give sufficiently accurate forward swap rates for long expiries, e.g. of 10 years or more. So, they are not much utilised in practice.) This means we need to somehow figure out how to deal with early exercise on a Monte Carlo, where we do not know the conditional expectation of the continuation value at a future point in time. We will discuss this further in Section 9.4.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Ehsan Mahmood

I’ve earned Masters Degree in Business Studies and specialized in Accounts & Finance. Couple with this, I have earned BS Sociology from renowned institute of Pakistan. Moreover, I have humongous teaching experience at Graduate and Post-graduate level to Business and humanities students along with more than 7 years of teaching experience to my foreign students Online. I’m also professional writer and write for numerous academic journals pertaining to educational institutes periodically.

4.90+

248+ Reviews

287+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Using the same approach as in section 7.8.1 on page 159, show that the effect of a spin echo (in a homonuclear system) on the terms 21x2z and 21yz is as follows: Using the idea that a spin echo is...

-

Using the same approach as in section 10.9.4 on page 364, determine the form of the two-dimensional multiplets arising from the combinations S3 and S4, and hence verify that by further combining...

-

What does the following code fragment print? int[] a = { 1, 2, 3 }; int[] b = { 1, 2, 3 }; System.out.println(a == b);

-

(a) Kristina Desmet believes that the analysis of financial statements is directed at two characteristics of a company: liquidity and profitability. Is Kristina correct? Explain. (b) Are short-term...

-

Explain why QUOTE is needed for a parameter that is a data list.

-

Distinguish between ideal standard and normal standard.

-

(1) Who are the two parties to a lease transaction? (2) What are the five primary types of leases, and what are their characteristics? (3) How are leases classified for tax purposes? (4) What effect...

-

AirQual Test Corporation provides on - site air quality testing services. The company provided the following cost formulas and actual results for the month of February: \ table [ [ , \ table [ [...

-

Consider a two-factor short rate model described by dx t = where t,T is the HJM instantaneous forward rate. -Kr(t) xidt + oz(t)dWF, dyt -Ky(t)yidt + oy(t)dW!', rt = y(t) + x + yt and dWdW? = p(t)dt....

-

Consider the diffusion equation that the scheme is stable. Show also that the implicit scheme is unconditionally stable. t = 82 u Let u ||

-

Hannibal Steel Company has a Transport Services Department that provides trucks to haul ore from the companys mine to its two steel millsthe Northern Plant and the Southern Plant. Budgeted costs for...

-

1. Using appropriate examples, compare and contrast the genetic diversity of marine fish species with freshwater fish species (8 marks) 2. Your class went on a trip and discovered a crater lake on...

-

Find sin(29) given that cos(0) = and 0

-

Amazing Aquariums began as a class project on new business development. Now that the visionaries behind the idea have graduated, they want to explore their business idea and see if the concept could...

-

3. Modify the program of Example 05 so that, it takes and prints values using the following two functions respectively. void get (double *&a, int& n); void print (double *a, int n); 4. Following is a...

-

A company will be financing its operations with and a capital budget is P40,000,000 and a debt-to-equity ratio of 1. The interest rate on company's debt is 10%. The expected return on equity by the...

-

The longer a loan schedule lasts, the more interest you will pay. To illustrate a $20,000-car-loan at 9% APR (compounded monthly) for three years (36 monthly payments) will incur total interest of...

-

You've been asked to take over leadership of a group of paralegals that once had a reputation for being a tight-knit, supportive team, but you quickly figure out that this team is in danger of...

-

Identify which compounds below possess a molecular dipole moment and indicate the direction of that dipole moment: a. b. c. d. :i: i: .CI: II .C. .C. H. :: :Cl: . .C. .C. di: . CHO

-

A mixture of sulfuric acid and nitric acid will produce small quantities of the nitronium ion (NO2 + ): Does the nitronium ion have any significant resonance structures? Why or why not? o==o:

-

Consider the structure of ozone: Ozone is formed in the upper atmosphere, where it absorbs short-wavelength UV radiation emitted by the sun, thereby protecting us from harmful radiation. Draw all...

-

BE13.2 (LO 1), AP An inexperienced accountant for Silva Corporation showed the following in the income statement: net income \$337,500 and unrealized gain on availablefor-sale securities (before...

-

A start - up company is seeking $ 5 m for its Series A investment round. The start - up is expected to grow to $ 1 0 0 M in sales and $ 1 0 M in profit by year 5 . Comparable firms in the industry...

-

Here are the cash flows for a project under consideration: C 0 C 1 C 2 $8,010 +$5,940 +$20,160 a. Calculate the projects net present value for discount rates of 0, 50%, and 100%. (Round your answers...

Study smarter with the SolutionInn App