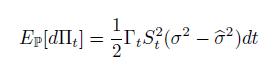

Consider a call option priced with implied volatility b where the actual stock volatility is given by

Question:

Consider a call option priced with implied volatility bσ where the actual stock volatility is given by σ. By considering the evolution of the portfolio

![]() together with the Black–Scholes equationapplied to the option’s price, show that the expected change in the portfolio value is given by:

together with the Black–Scholes equationapplied to the option’s price, show that the expected change in the portfolio value is given by:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

The Value Of Uncertainty Dealing With Risk In The Equity Derivatives Market

ISBN: 9781848167728,9781908979582

1st Edition

Authors: George Kaye

Question Posted: