At the close of business on May 31, 2018, Alaska Corporation exchanges $2 million of its voting

Question:

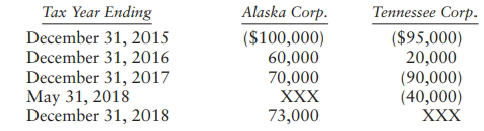

At the close of business on May 31, 2018, Alaska Corporation exchanges $2 million of its voting common stock for all the noncash assets of Tennessee Corporation. Tennessee uses its cash to pay off its liabilities and then liquidates. Tennessee and Alaska report the following taxable income (loss):

a. What tax returns must Alaska and Tennessee file for 2018?

b. What amount of the NOL carryover does Alaska acquire? In your calculation, disregard the 80% of taxable income NOL limitation.

c. Ignoring any implications of Sec. 382, what amount of Tennessee's NOL can Alaska use in 2018?

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted: