Will, a bachelor, died in 2018. At that time, his sole asset was cash of $15 million.

Question:

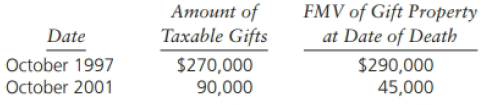

Will, a bachelor, died in 2018. At that time, his sole asset was cash of $15 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as follows:

a. What was Will's estate tax base?

b. How would your answer to Part a change if Will made the first gift in 1974 (instead of 1997)?

Transcribed Image Text:

Атоunt of Taxable Gifts FMV of Gift Property at Date of Death Date October 1997 October 2001 $270,000 90,000 $290,000 45,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

a Gross estate and taxable estate 15000000 Plus Adjusted taxable gifts 360000 ...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted:

Students also viewed these Business questions

-

Will, a bachelor, died in 2015. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as...

-

Will, a bachelor, died in 2016. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as...

-

Will, a bachelor, died in 2014. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as...

-

Deuterium ( ) is an attractive fuel for fusion reactions because it is abundant in the oceans, where about 0.015% of the hydrogen atoms in the water (H 2 O) are deuterium atoms. (a) How many...

-

In each of Problems a to c, sketch the graph of the given Cartesian equation, and then find the polar equation for it. a. x - 3y + 2 = 0 b. x = 0 c. y = -2

-

The drinking fountain is designed such that the nozzle is located a distance away from the edge of the basin as shown. Determine the maximum and minimum speed at which water can be ejected from the...

-

Classifying balance sheet items: The following are common categories on a classified balance sheet. A. Current assets D. Intangible assets B. Long-term investments E. Current liabilities F. Long-term...

-

1. Make a list of the elements that are interrelated or interdependent. Then write a paragraph stating why it is critical to monitor these elements closely. 2. Decide on the boundaries and ultimate...

-

just wondering if this is answer d? 9. Which of the following correctly matches the activity with its type? O A. Financing - selling a truck used for deliveries. O B. Operating purchasing a factory...

-

? ?? ? ? Assume that Alpha and Omega compete in the same four-digit SIC code industry and offer comparable products and services. The following table contains their reported financial performance and...

-

Sam Snider died February 14, 2017, survived by his spouse Janet and several children. Sam had not made any taxable gifts. Sam's gross estate was $7 million. In each of the following independent...

-

Given the following financial statements,historical ratios, and industry averages, calculate Sterling Companys financial ratios for the most recent year. (Assume a 365-day year.) Analyze its overall...

-

What is the remaining balance after payment 94 ? Use the amortization schedule to answer the question. Loan Amount Interst Rate (annual) Term (Years) Amortization Schedule Calculator $168,458.00...

-

You are expected to suggest several functional tactics and how these short-term activities are used to achieve short term objectives and establish a competitive advantage. Within the general...

-

Carbon dioxide and nitrogen experience equimolar counterdiffusion in a circular tube whose length and diameter are 1m and 50mm, respectively. The system is at a total pressure of 1 atm and a...

-

A licensee recently was placed on court - ordered probation. Does the licensee have to report this to the Board?

-

1. Technology and Operations What task does the operations function in a manufacturing organisation and in a service organisation perform? How does operations strategy contribute to make to corporate...

-

Do the Following current market analysis - geographic , psychographic and behavioral of Klean Kanteen THIS IS THE DETAILS AND DRAFTS OF PAPER. (THIS IS THE BASIS) Open the link;...

-

A heat pump that operates on the ideal vapor-compression cycle with refrigerant-134a is used to heat a house and maintain it at 75F by using underground water at 50F as the heat source. The house is...

-

Pappa's Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are...

-

If the general market demand for mens shoes is fairly elastic, how does the demand for mens dress shoes compare to it? How does the demand curve for womens shoes compare to the demand curve for mens...

-

If the demand for perfume is inelastic above and below the present price, should the price be raised? Why or why not?

-

If the demand for shrimp is highly elastic below the present price, should the price be lowered?

-

explain in excel please For a particular product the price per unit is $6. Calculate Revenue if sales in current period is 200 units. Conduct a data analysis, on revenue by changing the number of...

-

Hall Company sells merchandise with a one-year warranty. In the current year, sales consist of 35,000 units. It is estimated that warranty repairs will average $10 per unit sold and 30% of the...

-

Q 4- Crane Corporation, an amusement park, is considering a capital investment in a new exhibit. The exhibit would cost $ 167,270 and have an estimated useful life of 7 years. It can be sold for $...

Study smarter with the SolutionInn App