Given the following financial statements,historical ratios, and industry averages, calculate Sterling Companys financial ratios for the most

Question:

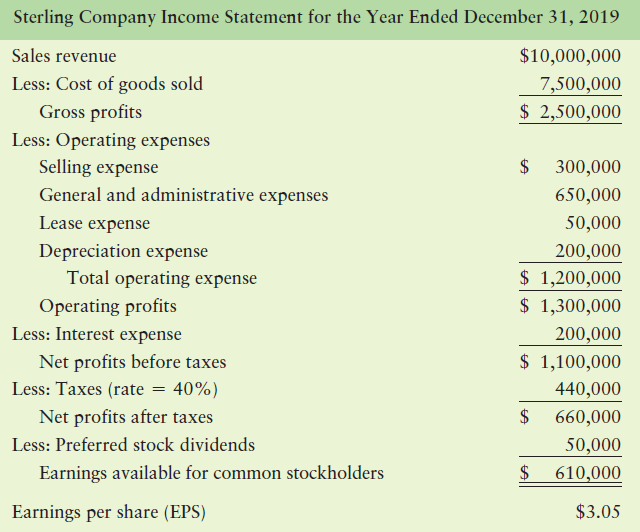

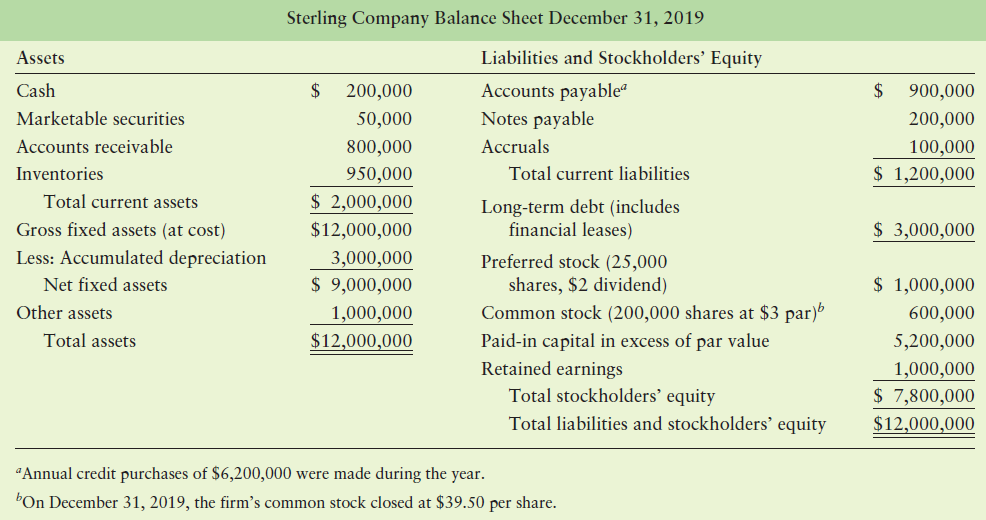

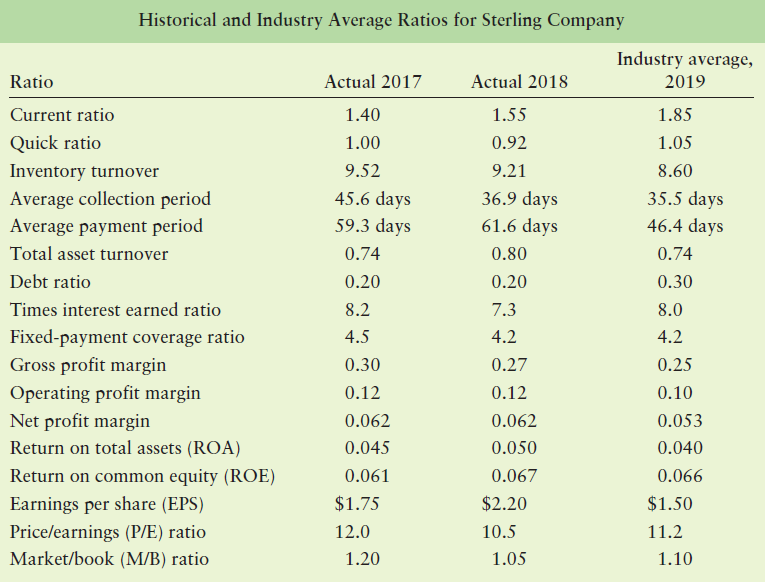

Given the following financial statements,historical ratios, and industry averages, calculate Sterling Company’s financial ratios for the most recent year. (Assume a 365-day year.)

Analyze its overall financial situation from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm’s liquidity, activity, debt, profitability, and market.

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Sterling Company Income Statement for the Year Ended December 31, 2019 Sales revenue $10,000,000 Less: Cost of goods sold 7,500,000 $ 2,500,000 Gross profits Less: Operating expenses Selling expense 300,000 General and administrative expenses 650,000 Lease expense 50,000 Depreciation expense Total operating expense 200,000 $ 1,200,000 $ 1,300,000 Operating profits Less: Interest expense 200,000 $ 1,100,000 Net profits before taxes Less: Taxes (rate = 40%) 440,000 Net profits after taxes 660,000 Less: Preferred stock dividends 50,000 Earnings available for common stockholders 610,000 $3.05 Earnings per share (EPS) Sterling Company Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Accounts payable Notes payable Cash 2$ 200,000 2$ 900,000 Marketable securities 50,000 200,000 Accounts receivable 800,000 Accruals 100,000 Inventories 950,000 Total current liabilities $ 1,200,000 Total current assets $ 2,000,000 Long-term debt (includes financial leases) Gross fixed assets (at cost) $12,000,000 $ 3,000,000 Less: Accumulated depreciation 3,000,000 $ 9,000,000 Preferred stock (25,000 shares, $2 dividend) Net fixed assets $ 1,000,000 Other assets 1,000,000 Common stock (200,000 shares at $3 par)b 600,000 Total assets $12,000,000 Paid-in capital in excess of par value 5,200,000 Retained earnings 1,000,000 $ 7,800,000 Total stockholders’ equity Total liabilities and stockholders’ equity $12,000,000 "Annual credit purchases of $6,200,000 were made during the year. On December 31, 2019, the firm's common stock closed at $39.50 per share.

Step by Step Answer:

Sterling Company x Ratio Analysis Given Actual Given Actual Actual Given Industry TSTime Series Ratio 2017 2018 2019 2019 CSCrossSectional Liquidity Current ratio 140 155 167 185 TSImproving CSBelow P...View the full answer

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Joseph Jernigan died in 2018 with a taxable estate of $4.1 million. He was survived by his spouse Josephine and several children. He made taxable gifts of $100,000 in 1974 and $650,000 in 2000. The...

-

Consider the following balance sheets and selected data from the income statement of Keith Corporation. a. Calculate the firms net operating profit after taxes (NOPAT) for the year ended December 31,...

-

It is never too soon to begin investing for a childs college education. Using the information provided at MyLab Finance, determine the present value you would need to invest today to ensure that your...

-

Using the adjustment data listed in P3-2 for San Mateo Health Care, indicate the effects of each adjustment on the liquidity metric Quick Assets and profitability metric Net Income - Accrual Basis....

-

Plot the points whose polar coordinates are (3, 1/3), (1, 1/2), (4, 1/3), (0, ), (1, 4), (3, 11/7), (5/3, 1/2), and (4, 0).

-

The skateboard rider leaves the ramp at A with an initial velocity v A at a 30 angle. If he strikes the ground at B determine v A and the time of flight. A VA 1 m 30 -5 m- B

-

Complete the following descriptions related to temporary and permanent accounts. 1. Permanent accounts report on activities related to_future accounting periods, and they carry their ending balances...

-

Two staff analysts for the city of Bridgmont, Pennsylvania, disagree regarding the effects of seniority and continuing education on promotions in the city government. One of them believes that...

-

What is Intelligence,Empathy,Communication, & Self- awareness?

-

On January 1, 20X1, Pluto Company acquired all of Saturn Companys common stock for $1,000,000 cash. On that date, Saturn had retained earnings of $200,000 and common stock of $600,000. The book...

-

Will, a bachelor, died in 2018. At that time, his sole asset was cash of $15 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as...

-

Use the following 2016 financial information for ATT and Verizon to conduct a DuPont system of analysis for each company. a. Which company has the higher net profit margin? Higher asset turnover? b....

-

At 30 June 2021, the leave provision general ledger balances for the employees of Joan Patricia were annual leave $7382, sick and carers leave $3395 and long service leave $2569. No adjustments were...

-

who do you think sets the underlying ethical standards when the law is fuzzy on an issue? as business and societal issues develop in the future, how does your opinion in this area inform your...

-

how do i introduce low risk high reward for a new medical assistant supervisor role in an organization?

-

How do individual differences in cognitive styles, such as analytical versus intuitive thinking, impact problem-solving approaches and decision-making processes within teams ?

-

In Russian government, do you think that Russian Military Performance is good in warfare against Ukraine? Explain.

-

Why do you think the competing values framework is important to an organization's effectiveness? Describe the four profiles of the competing values framework. Identify one of the profiles and provide...

-

A gas turbine for an automobile is designed with a regenerator. Air enters the compressor of this engine at 100 kPa and 30C. The compressor pressure ratio is 8; the maximum cycle temperature is 800C;...

-

Frontland Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Frontland had to replace an inexperienced office worker in charge of bookkeeping because of...

-

Raina Herzig wishes to choose the best of four immediate-retirement annuities available to her. In each case, in exchange for paying a single premium today, she will receive equal, annual,...

-

What is the real rate of interest? Differentiate it from the nominal rate of interest for the risk-free asset, a 3-month U.S. Treasury bill.

-

How is the cost of bond financing typically related to the cost of short-term borrowing? In addition to a bonds maturity, what other major factors affect its cost to the issuer?

-

Q1) The equity of Washington Ltd at 1 July 2020 consisted of: Share capital 500 000 A ordinary shares fully paid $1 500 000 400 000 B ordinary shares issued for $2 and paid to $1.50 600 000 General...

-

out The following information relates to Questions 1 to 2. The management accountant of a furniture manufacturer is developing a standard for the labour cost of one massage chair. When operating at...

-

Exercise 10-8 Utilization of a constrained Resource [LO10-5, L010-6] Barlow Company manufactures three products: A, B, and C. The selling price, variable costs, and contribution margin for one unit...

Study smarter with the SolutionInn App