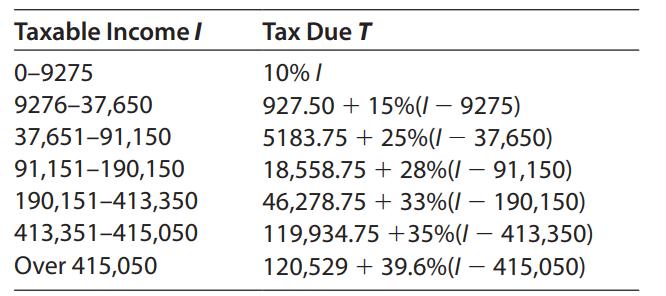

Use the following federal tax table for a single person claiming one personal exemption. (a) Write the

Question:

Use the following federal tax table for a single person claiming one personal exemption.

(a) Write the last three taxable income ranges as inequalities.

(b) If an individual has a taxable income of $37,650 calculate the tax due. Repeat this calculation for a taxable income of $91,150.

(c) Write an interval that represents the amount of tax due for a taxable income between $37,650 and $91,150.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Mathematical Applications For The Management, Life And Social Sciences

ISBN: 9781337625340

12th Edition

Authors: Ronald J. Harshbarger, James J. Reynolds

Question Posted: