Consider the continuous time equivalent of the HoLee model as a degenerate case of the HullWhite model,

Question:

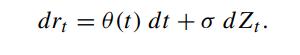

Consider the continuous time equivalent of the Ho–Lee model as a degenerate case of the Hull–White model, where the diffusion process for the short rate rt under the risk neutral measure Q is given by

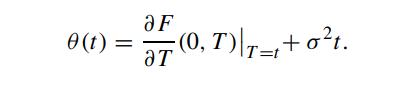

Show that the parameter θ(t) is related to the slope of the initial forward rate curve through the following formula

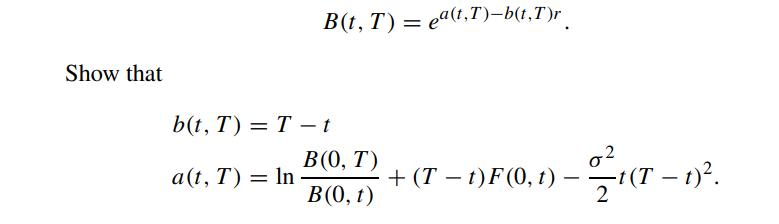

The bond price function can be shown to admit the affine form where

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: