Consider the two-factor Gaussian model, which is a combination of the HoLee and Vasicek models. Let the

Question:

Consider the two-factor Gaussian model, which is a combination of the Ho–Lee and Vasicek models. Let the volatility structure in the HJM framework be given by

![]()

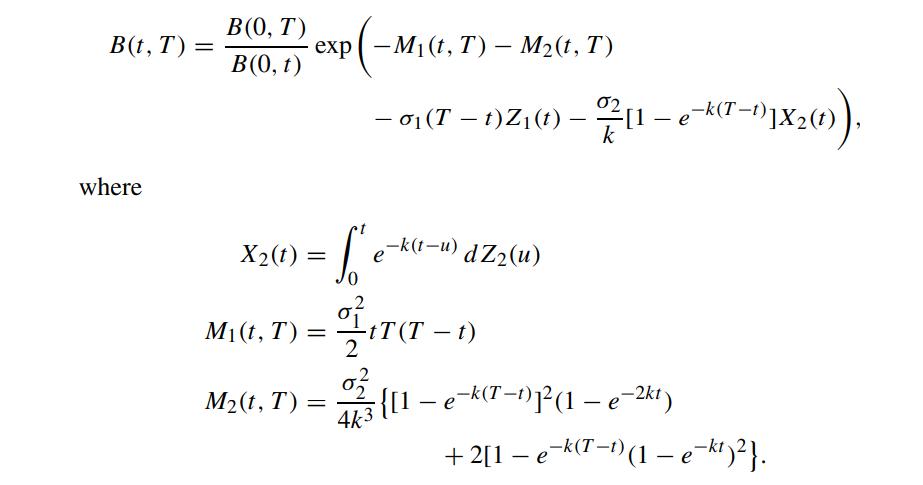

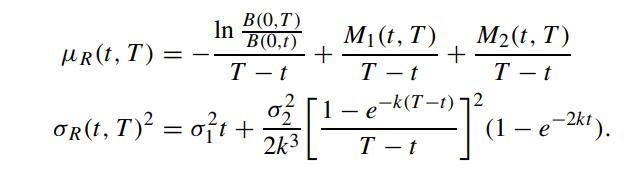

Show that the bond price B(t, T) is given by (Heath, Jarrow and Morton, 1992).

Also, show that the yield to maturity R(t, T) is normally distributed with mean μR(t, T) and variance σR(t, T)2:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: