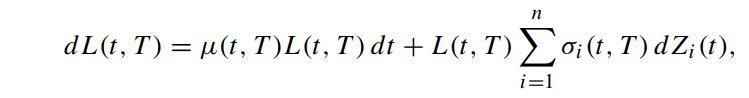

Suppose the forward LIBOR L(t,T) satisfies the following stochastic differential equation under the risk neutral Q-measure where

Question:

Suppose the forward LIBOR L(t,T) satisfies the following stochastic differential equation under the risk neutral Q-measure

where σi(t, T), i = 1, 2, ··· ,n are deterministic volatility functions and Z(t) = (Z1(t)···Zn(t))T is Q-Brownian. Define

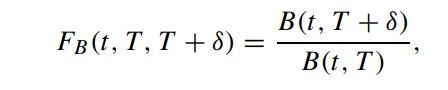

where σi(t, T), i = 1, 2, ··· ,n are deterministic volatility functions and Z(t) = (Z1(t)···Zn(t))T is Q-Brownian. Define

which is the time-t price of the T-forward on the T +δ-maturity discount bond. Under the QT -measure, show that FB(t) satisfies

![n dF(t) = F(t)[1 FB(t)] o(t, T) dZ? (t1), i=1](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/9/410655db2b26cd931700639409746.jpg) where ZT (t) = (ZT1 (t)···ZTn (t))T is QT -Brownian. Let V (x,t) denote the forward price of the T-maturity put option on the (T +δ)-maturity bond, where x is the forward bond price. Show that V satisfies

where ZT (t) = (ZT1 (t)···ZTn (t))T is QT -Brownian. Let V (x,t) denote the forward price of the T-maturity put option on the (T +δ)-maturity bond, where x is the forward bond price. Show that V satisfies

![n a2V 0. = ++[4-2000] 0 0x2 i=1 aV 1 at](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/9/489655db3010d0ca1700639488059.jpg)

with the terminal condition: V (x,T ) = max(X − x, 0). Here, X is the strike price of the put. Solve for V (x,t) (Miltersen, Sandmann and Sondermann, 1997).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: