Consider the Lognormal LIBOR Market (LLM) model for the LIBOR L i (t), i = 0, 1,

Question:

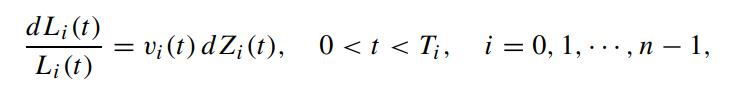

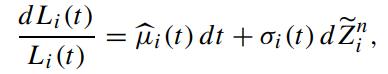

Consider the Lognormal LIBOR Market (LLM) model for the LIBOR Li(t), i = 0, 1, ··· ,n − 1, defined on the tenor structure {T0,T1, ··· ,Tn} where 0 0 1 n. Let vi(t) denote the scalar volatility function of Li(t), and write Li(0) = Li,0,i = 0, 1, ··· ,n − 1. Now, Li(t) satisfies

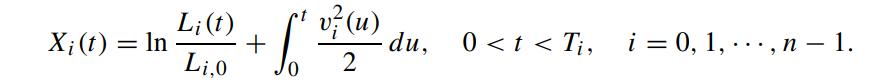

where Zi(t) is QTi-Brownian. We write ρij (t) as the correlation coefficient between Zi(t) and Zj (t) such that ρij (t)dt = dZi(t)dZj (t). Define

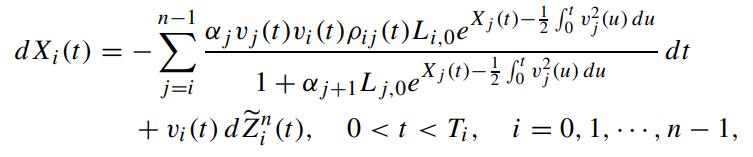

Under the terminal measure QTn , show that Xi(t) satisfies the following stochastic differential equation

with initial condition: Xi(0) = 0, and Z̃in+1 (t) is QTn -Brownian under the Girsanov transformation: QTi → QTn.

with initial condition: Xi(0) = 0, and Z̃in+1 (t) is QTn -Brownian under the Girsanov transformation: QTi → QTn.

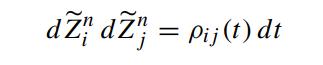

Note that Z̃n1 , ··· ,Z̃nn are QTn -Brownian and

since an equivalent change of a probability measure preserves the correlation between the Brownian processes. We write formally

and subsequently μ̂i(t) is determined. Recall

![and observe that B(t, Ti) = B(t, Ti+1)[1 + i+1L; (t)] B(t, Ti+1)(t)L (t) dt = dB(t, Ti+1) dL; (t) n-1 = =](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/4/1/174655db996589d51700641173750.jpg)

Step by Step Answer: