Suppose the strike prices X 1 and X 2 satisfy X 2 > X 1 , show

Question:

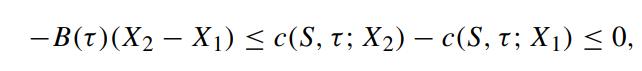

Suppose the strike prices X1 and X2 satisfy X2 > X1, show that for European calls on a nondividend paying asset, the difference in the call values satisfies

where B(τ) is the value of a pure discount bond with par value of unity and time to maturity τ . Furthermore, deduce that

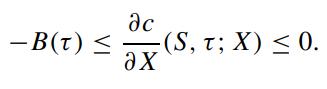

where B(τ) is the value of a pure discount bond with par value of unity and time to maturity τ . Furthermore, deduce that

In other words, suppose the call price can be expressed as a differentiable function of the strike price, then the derivative must be nonpositive and not greater in absolute value than the price of a pure discount bond of the same maturity. Do the above results also hold for European/American calls on a dividend paying asset?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: