The forward rate over the future period (T 1 ,T 2 ] as observed at the earlier

Question:

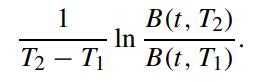

The forward rate over the future period (T1,T2] as observed at the earlier time t can be computed from bond prices by the formula

On the other hand, the futures rate is given by the expectation of the T2-maturity short rate observed at T1 under the risk neutral measure conditional on the information at t. Find the spread between the forward rate and the futures rate, assuming that the interest rate dynamics follows the Hull–White model.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: