Under the risk neutral measure Q, the stochastic process of the logarithm of the asset price x

Question:

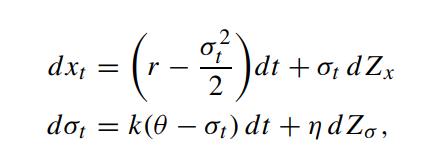

Under the risk neutral measure Q, the stochastic process of the logarithm of the asset price xt = ln St and its instantaneous volatility σt are assumed to be governed by

where dZx dZσ = ρdt. All model parameters are taken to be constant. The price function of a European call option with strike price X and maturity date T takes the form

![where Fj c(St, ot, t; T) = S F e-r(T-1) X Fo, F-+Re()do. fj (0) e-ix JO fo(0) Elexp(ixT)], fi(0) = E[exp(-r](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/1/312655b4920723691700481305869.jpg)

Solve for f0(∅) and f1(∅) (Schöbel and Zhu, 1999).

Transcribed Image Text:

(r-2/2² ) dt + dot = k(0o₁) dt+nd Zo, dxt = dt + ot dZx

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

The equations provided seem to involve a stochastic differential equation SDE describing the dynamic...View the full answer

Answered By

Saikumar Ramagiri

Financial accounting:- Journal and ledgers, preparation of trail balance and adjusted trail balance Preparation of income statement, retained earning statement and balance sheet Banks reconciliation statements Financial statement analysis Cash flow statement analysis (both direct and indirect methods) All methods of Depreciations Management Accounting:- Ratios Budgeting control Cash budget and production budget Working capital management Receivable management Costing:- Standard and variance costing Marginal costing and decision making Cost-volume-profit analysis Inventory management (LIFO, FIFO) Preparation and estimation of cost sheet Portfolio management:- Calculation of portfolio standard deviation or risk Calculation of portfolio expected returns CAPM, Beta Financial management:- Time value of money Capital budgeting Cost of capital Leverage analysis and capital structure policies Dividend policy Bond value calculations like YTM, current yield etc International finance:- Derivatives Futures and options Swaps and forwards Business problems Finance problems Education (mention all your degrees, year awarded, Institute/University, field(s) of major): Education Qualification Board/Institution/ University Month/Year of Passing % Secured OPTIONALS/ Major ICWAI(inter) ICWAI inter Pursuing Pursuing - M.com(Finance) Osmania University June 2007 65 Finance & Taxation M B A (Finance) Osmania University Dec 2004 66 Finance & Marketing. B.Com Osmania University June 2002 72 Income Tax, Cost & Mgt, Accountancy, Auditing. Intermediate (XII) Board of Intermediate May 1999 58 Mathematics, Accountancy, Economics. S S C (X) S S C Board. May 1997 74 Mathematics, Social Studies, Science. Tutoring experience: • 10 year experience in online trouble shooting problems related to finance/accountancy. • Since 6 Years working with solution inn as a tutor, I have solved thousands of questions, quick and accuracy Skills (optional): Technical Exposure: MS Office, SQL, Tally, Wings, Focus, Programming with C Financial : Portfolio/Financial Management, Ratio Analysis, Capital Budgeting Stock Valuation & Dividend Policy, Bond Valuations Individual Skills : Proactive Nature, Self Motivative, Clear thought process, Quick problem solving skills, flexible to complex situations. Achievements : 1. I have received an Award certificate from Local Area MLA for the cause of getting 100% marks in Accountancy during my Graduation. 2. I have received a GOLD MEDAL/Scholarship from Home Minister in my MBA for being the “Top Rank student “ of management institute. 3. I received numerous complements and extra pay from various students for trouble shooting their online problems. Other interests/Hobbies (optional): ? Web Surfing ? Sports ? Watching Comics, News channels ? Miniature Collection ? Exploring hidden facts ? Solving riddles and puzzles

4.80+

391+ Reviews

552+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The price function of a European call option under stochastic interest rates can also be solved using the partial differential equation approach. Let the asset value process S t and the short rate...

-

3. The sketch shows an exploded drawing of a pump driven by a 1.5-kW, 1800-rpm motor integrally attached to a 4:1 ratio gear reducer. Reducer shaft C is connected directly to pump shaft C' through a...

-

We would like to price the floor on the composition defined in Problem 8.22 using the LIBOR Market model. Now, we assume that the LIBOR Li(t) follows the arithmetic Brownian process: Problem 8.22...

-

Football Comm LLC is a manufacturer of devices for football coaches and their coaching staffs that enable them to quickly and effectively communicate with one another during a game through a wireless...

-

How should rainy day funds be reported under GASB Statement 54 ?

-

Your employer, a mid-sized human resources management company, is considering expansion into related fields, including the acquisition of Temp Force Company, an employ mentagency that supplies word...

-

When a company purchases treasury stock, (a) retained earnings are restricted by the amount paid; (b) Retained Earnings is credited; or (c) it is retired. AppendixLO1

-

Summarized versions of Calabasa Corporations financial statements for two recent years are as follows. Requirement 1. Complete Calabasa Corporations financial statements by determining the missing...

-

A company uses a product that must be delivered by special trucks. As such, ordering (and delivery) costs are relatively high, at $3,600 per order. The product is packaged in four-liter containers....

-

Consider the European zero-rebate up-and-out put option with an exponential barrier: B() = Be , where B() > X for all . Show that the price of this barrier put option is given by where p E (S, ) is...

-

By applying the following transformation on the dependent variable in the BlackScholes equation while the auxiliary conditions are transformed to become Consider the following diffusion equation...

-

In Exercises 3756, solve each formula for the specified variable. Do you recognize the formula? If so, what does it describe? S = P + Prt for r

-

there are some solbeed with direct materials. this one says direct labor. any help would be appreciated, ive been stuck Chapter 9 Homework Save 1.5 6 H 305 Parker Plastic, Incorporated, manufactures...

-

Give examples of applications where pumps might be connected in series. Give examples of applications where pumps might be connected in parallel. Drawing on the conclusions of earlier exercises,...

-

a truck company has 2 trucks, which are hired out day by day. The average number of trucks hired on a day follows a distribution with mean 1 . 5 . Identify the distribution and then find the...

-

Designand drive selectionfor a hydrostaticapplication.Choose anypropelledequipmentwithopen or closedloop HST. Includethepayloadand/or anymachinefunctionrequirementsfor the mobileequipment.A sketch...

-

A two stage air compressor with ideal intercooler pressure and perfect intercooling (what does this mean?) compresses air from 1 bar to 16 bar at the rate of 5 m3/min. Mechanical efficiency of the...

-

In Problems 1-3, indicate whether the given series converges or diverges and give a reason for your conclusion? 1. 2. 3. - bo In 1 t n R+ 5 1

-

What kind of financial pressures can an LBO cause?

-

If sales promotion spending continues to grow often at the expense of media advertis inghow do you think this might affect the rates charged by mass media for advertising time or space? How do you...

-

As a community service, disc jockeys from radio station WMKT formed a basketball team to help raise money for local nonprofit organizations. The host organization finds or fields a competing team and...

-

How should the acceptance of a profit-oriented, a sales-oriented, or a status quooriented pricing objective affect the development of a companys marketing strategy? Illustrate for each.

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App