Consider the European zero-rebate up-and-out put option with an exponential barrier: B() = Be , where

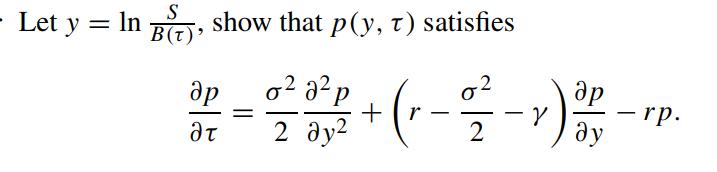

Question:

Consider the European zero-rebate up-and-out put option with an exponential barrier: B(τ) = Be−γτ , where B(τ) > X for all τ . Show that the price of this barrier put option is given by

![8-1 B(t) - [B(r)] + ' PE (B(5) x). 8 = (r = 1) 9 S S 02 p(S, T) = PE(S, T)](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/1/906655b4b7202add1700481903008.jpg) where pE (S, τ) is the price of the corresponding European vanilla put option. Deduce the price of the corresponding European up-and-in put option with the same barrier.

where pE (S, τ) is the price of the corresponding European vanilla put option. Deduce the price of the corresponding European up-and-in put option with the same barrier.

Transcribed Image Text:

8-1 B(t)² y) - [B(r)] - ' PE (B(5) ² x). 8 = ² (r =1) 9 S S 02 p(S, T) = PE(S, T) —

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

The European zerorebate upandout put option with an exponential barrier BT Be can be expressed in te...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Determine the derivative of each function. (a) y = x2x +5 (2x-6)4 (x+2)3 (b) y: 8. [6 marks]. A tangent to the parabola y = x - 4x + 5 is perpendicular to 2x + 8y + 50. Determine the equation of the...

-

Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 10%. Year 1 2 3 Payment $100 $200 $400 Round your answers to the nearest cent. PV of...

-

Round 3 8 . 1 7 7 6 1 to the nearest whole number

-

Create a T-Account Transaction Account titles Cash d Common stock Supplies Creditors accounts payable) Cash Fees earned Rent expense Cash Creditors(accounts payable) Cash Accounts receivable Fees...

-

Prepare budgetary entries, using general ledger accounts only, for each of the following unrelated situations: a. Anticipated revenues are $10 million; anticipated expenditures and encumbrances are...

-

Look back in the chapter to Table 15-1, which showed the balance sheets for Argile Textiles on three different dates. Argile's sales fluctuate during the year due to the seasonal nature of its...

-

How does treasury stock affect the authorized, issued, and outstanding shares? AppendixLO1

-

Four factors are thought to possibly influence the taste of a soft-drink beverage: type of sweetener (A), ratio of syrup to water (B), carbonation level (C), and temperature (D). Each factor can be...

-

Schaduie of cash collections of actounts recevabin The Acteunts Rectivable baibnce on Segteriber 10 was st2.090

-

Suppose the asset price follows the Geometric Brownian process with drift rate r and volatility under the risk neutral measure Q. Find the density function of the asset price S T at expiration time...

-

Under the risk neutral measure Q, the stochastic process of the logarithm of the asset price x t = ln S t and its instantaneous volatility t are assumed to be governed by where dZ x dZ = dt. All...

-

In simple terms, compare and contrast behavior analysis and psychoanalysis. LO2

-

MATA 31 Calculus 1 winter 2024 Problem Set 2 Feb 11 Feb 18 on Crowdmark Each question is 25 points. 1. (25) (a) (15) Given that lim 3 2x + 3 for = 0.1 = 3, find the largest & that works (b) (10) Find...

-

A retailer has product demand 9600 units a year. The carrying cost of one unit of the product is $3.50 per year. Ordering costs are $28 per order. a. What is the Economic Order Quantity (EOQ)? (2...

-

How do I key in this into journal entries Crest Pte Ltd Trial Balance Cash Accounts receivable, Augusta Office Equipment Opening Bal as at 1 Mar 2021 Debit (5) Credit ($) 15,000 5,000 13,000...

-

If an atomic layer is approximately 0.1nm thick, how fast are the protein synthesis machines working in atomiclayers/satomiclayers/s?

-

Consider the 4 sets of data shown below for v(t) the velocity of an object in freefall with the corresponding linear curve fits. The slope of the best fit line gives the acceleration, and for...

-

In Problems 1-3, state whether the given series is absolutely convergent, conditionally convergent, or divergent? 1. 2. 3. 3" 2" n=

-

What did Lennox gain by integrating their WMS, TMS, and labor management systems?

-

Discuss some ways that a firm can link its sales promotion activities to its advertising and personal selling effortsso that all of its promotion efforts result in an integrated effort.

-

Indicate the type of sales promotion that a producer might use in each of the following situations and briefly explain your reasons: a. A firm has developed an improved razor blade and obtained...

-

Why wouldnt a producer of toothpaste just lower the price of its product rather than offer consumers a price-off coupon?

-

How to solve general ledger cash balance chapter 9 assignment 5

-

On 31 July 2018, Sipho bought 1 000 ordinary shares in ABC Ltd at a cost of R2 750. On 31 December 2018 the company made a 1 for 10 bonus issue. On 31 March 2019, Sipho sold 300 shares for R800. What...

-

If you purchase a $1000 par value bond for $1065 that has a 6 3/8% coupon rate and 15 years until maturity, what will be your annual return? 5.5% 5.9% 5.7% 6.1%

Study smarter with the SolutionInn App