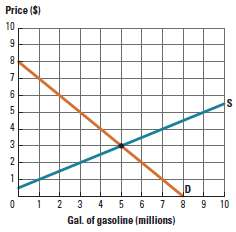

Figure 20P-1 shows a hypothetical market for gasoline. a. Suppose an excise tax of $1.50 per gallon

Question:

a. Suppose an excise tax of $1.50 per gallon is levied on gasoline suppliers. Draw the after-tax supply curve. What price will consumers pay? What price will sellers receive?

b. How much government revenue will result from the tax?

c. Suppose the tax is raised to $3 per gallon. Draw the new after-tax supply curve. How much additional revenue will this raise compared to the $1.50 tax?

d. Suppose the tax is raised again to $4.50 per gallon. Draw the new after-tax supply curve. Does this newest tax increase cause tax revenue to increase, decrease, or remain the same as compared to the $3 per gallon tax?

Figure 20P-1:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: