Question: The Problem 3 worksheet contains annual returns on stocks, T-bills, and T-bonds. Find and interpret the correlations between each pair of the annual returns on

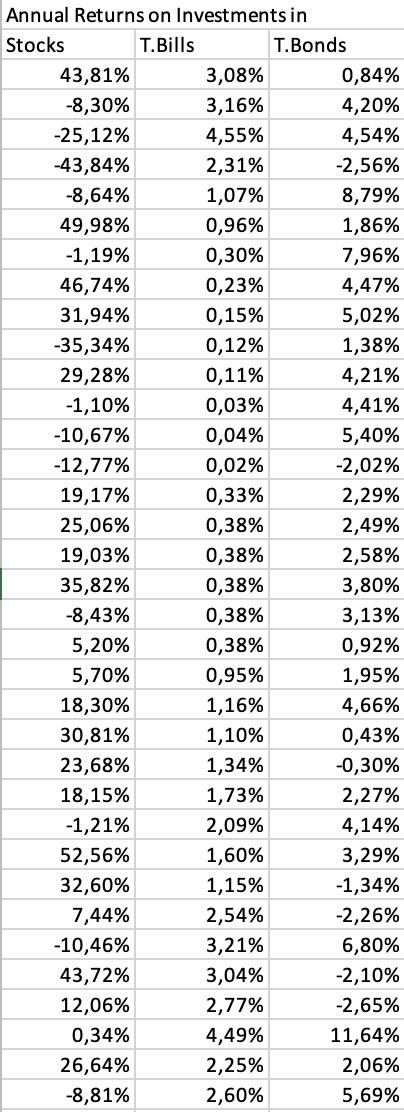

The Problem 3 worksheet contains annual returns on stocks, T-bills, and T-bonds. Find and interpret the correlations between each pair of the annual returns on these three classes of investments.

Run a descriptive statistics on the stocks column of the Returns worksheet. Next to each returned value write a one-sentence definition, in your own words, of what that number tells you.

Annual Returns on Investments in Stocks T.Bills 43,81% -8,30% -25,12% -43,84% -8,64% 49,98% -1,19% 46,74% 31,94% -35,34% 29,28% -1,10% -10,67% -12,77% 19,17% 25,06% 19,03% 35,82% -8,43% 5,20% 5,70% 18,30% 30,81% 23,68% 18,15% -1,21% 52,56% 32,60% 7,44% -10,46% 43,72% 12,06% 0,34% 26,64% -8,81% 3,08% 3,16% 4,55% 2,31% 1,07% 0,96% 0,30% 0,23% 0,15% 0,12% 0,11% 0,03% 0,04% 0,02% 0,33% 0,38% 0,38% 0,38% 0,38% 0,38% 0,95% 1,16% 1,10% 1,34% 1,73% 2,09% 1,60% 1,15% 2,54% 3,21% 3,04% 2,77% 4,49% 2,25% 2,60% T.Bonds 0,84% 4,20% 4,54% -2,56% 8,79% 1,86% 7,96% 4,47% 5,02% 1,38% 4,21% 4,41% 5,40% -2,02% 2,29% 2,49% 2,58% 3,80% 3,13% 0,92% 1,95% 4,66% 0,43% -0,30% 2,27% 4,14% 3,29% -1,34% -2,26% 6,80% -2,10% -2,65% 11,64% 2,06% 5,69%

Step by Step Solution

3.55 Rating (159 Votes )

There are 3 Steps involved in it

The correlation between Stocks and T Bills is 0153 This indicates a very weak correlationor no corre... View full answer

Get step-by-step solutions from verified subject matter experts