6. The CPA partners of Tan, Ullman & Valdez LLP shared net income and losses 25%, 35%,...

Question:

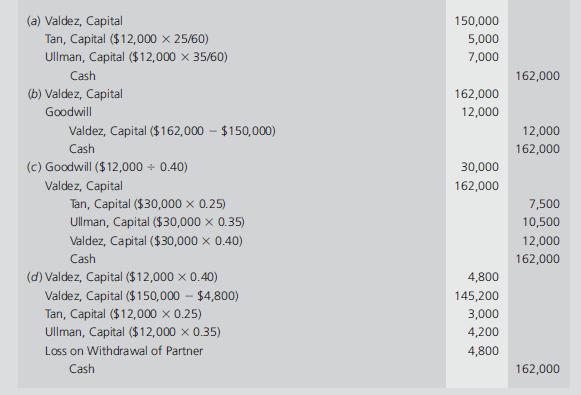

6. The CPA partners of Tan, Ullman & Valdez LLP shared net income and losses 25%, 35%, and 40%, respectively. On January 31, 2006, by mutual consent of the partners, Julio Valdez withdrew from the partnership, receiving $162,000 for his $150,000 capital account balance. The preferable journal entry (explanation omitted) for the partnership on January 31, 2006, is:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: