(a) Assume that all intercompany sales were upstream. Calculate the amount to be reported on the Year...

Question:

(a) Assume that all intercompany sales were upstream. Calculate the amount to be reported on the Year 7 consolidated financial statements for the following accounts/items:

(i) Consolidated net income

(ii) Consolidated net income attributable to the controlling and non-controlling interest

(iii) Deferred income tax asset

(iv) Inventory

(v) Net adjustment to retained earnings at beginning of year pertaining to intercompany sales

(vi) Net adjustment to retained earnings at end of year pertaining to intercompany sales

(b) Now, assume that all intercompany sales were downstream. Calculate the amount to be reported on the Year 7 consolidated financial statements for the accounts/items listed in part (a).

Yosef Corporation acquired 90% of the outstanding voting stock of Randeep Inc. on January 1, Year 6. During Year 6, intercompany sales of inventory of $45,000 (original cost of $27,000) were made. Only 20% of this inventory was still held within the consolidated entity at the end of Year 6 and was sold in Year 7. Intercompany sales of inventory of $60,000 (original cost of $33,000) occurred in Year 7. Of this merchandise, 30% had not been resold to outside parties by the end of the year.

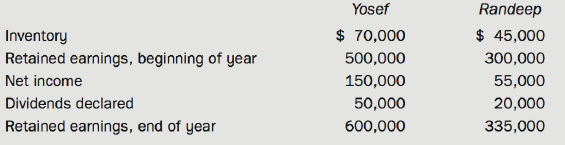

At the end of Year 7, selected figures from the two companies' financial statements were as follows:

Yosef uses the cost method to account for its investment in Randeep. Both companies pay income tax at the rate of 40%.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell