(a) Prepare a consolidated income statement for Year 9 with expenses classified by nature. (b) Calculate consolidated...

Question:

(a) Prepare a consolidated income statement for Year 9 with expenses classified by nature.

(b) Calculate consolidated retained earnings at December 31, Year 9.

(c) If Road had used parent company extension theory rather than entity theory, how would this affect the return on equity attributable to shareholders of Road for Year 9? Briefly explain.

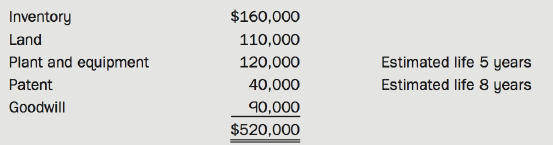

On January 2, Year 5, Road Ltd. acquired 70% of the outstanding voting shares of Runner Ltd. The acquisition differential of $520,000 on that date was allocated in the following manner:

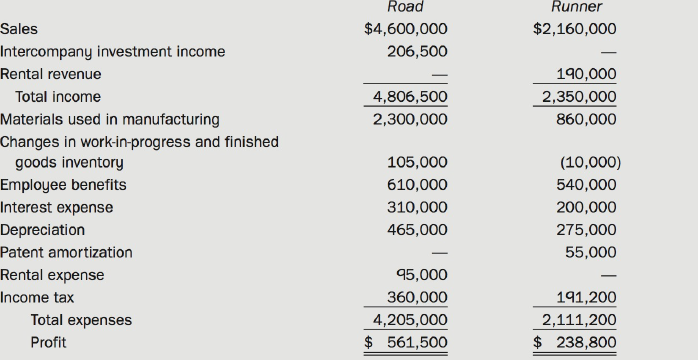

The Year 9 income statements for the two companies were as follows:

Additional Information:

• Runner regularly sells raw materials to Road. Intercompany sales in Year 9 totalled $480,000.

• Intercompany profits in the inventories of Road were as follows:

January 1, Year q $247,000

December 31, Year q 100,000

• Road's entire rental expense relates to equipment rented from Runner.

• A goodwill impairment loss of $3,000 occurred in Year 9.

• Retained earnings at December 31, Year 9, for Road and Runner were $2,523,300 and $1,210,000, respectively.

• Road uses the equity method to account for its investment, and uses income tax allocation at the rate of 40% when it prepares consolidated statements.

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell