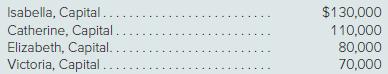

At year-end, the Queen City partnership has the following capital balances: Profits and losses are split on

Question:

At year-end, the Queen City partnership has the following capital balances:

Profits and losses are split on a 3:3:2:2 basis, respectively. Elizabeth decides to leave the partnership and is paid $90,000 from the business based on the original contractual agreement.

If instead the partnership uses the bonus method, compute the balance of Isabella’s capital account after Elizabeth withdraws.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Question Posted: