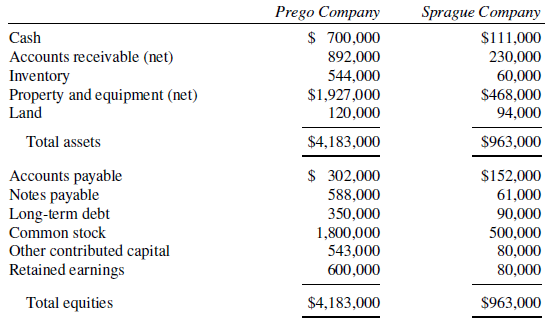

Balance sheets for Prego Company and Sprague Company as of December 31, 2018, follow: The fair values

Question:

Balance sheets for Prego Company and Sprague Company as of December 31, 2018, follow:

The fair values of Sprague Company?s assets and liabilities are equal to their book values.

Required:

Prepare a consolidated balance sheet as of January 1, 2019, under each of the following assumptions:

A. On January 1, 2019, Prego Company purchased 90% of the outstanding common stock of Sprague Company for $594,000.

B. On January 1, 2019, Prego Company exchanged 11,880 of its $20 par value common shares with a fair value of $50 per share for 90% of the outstanding common shares of Sprague Company. The transaction is a purchase.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: